Award-winning PDF software

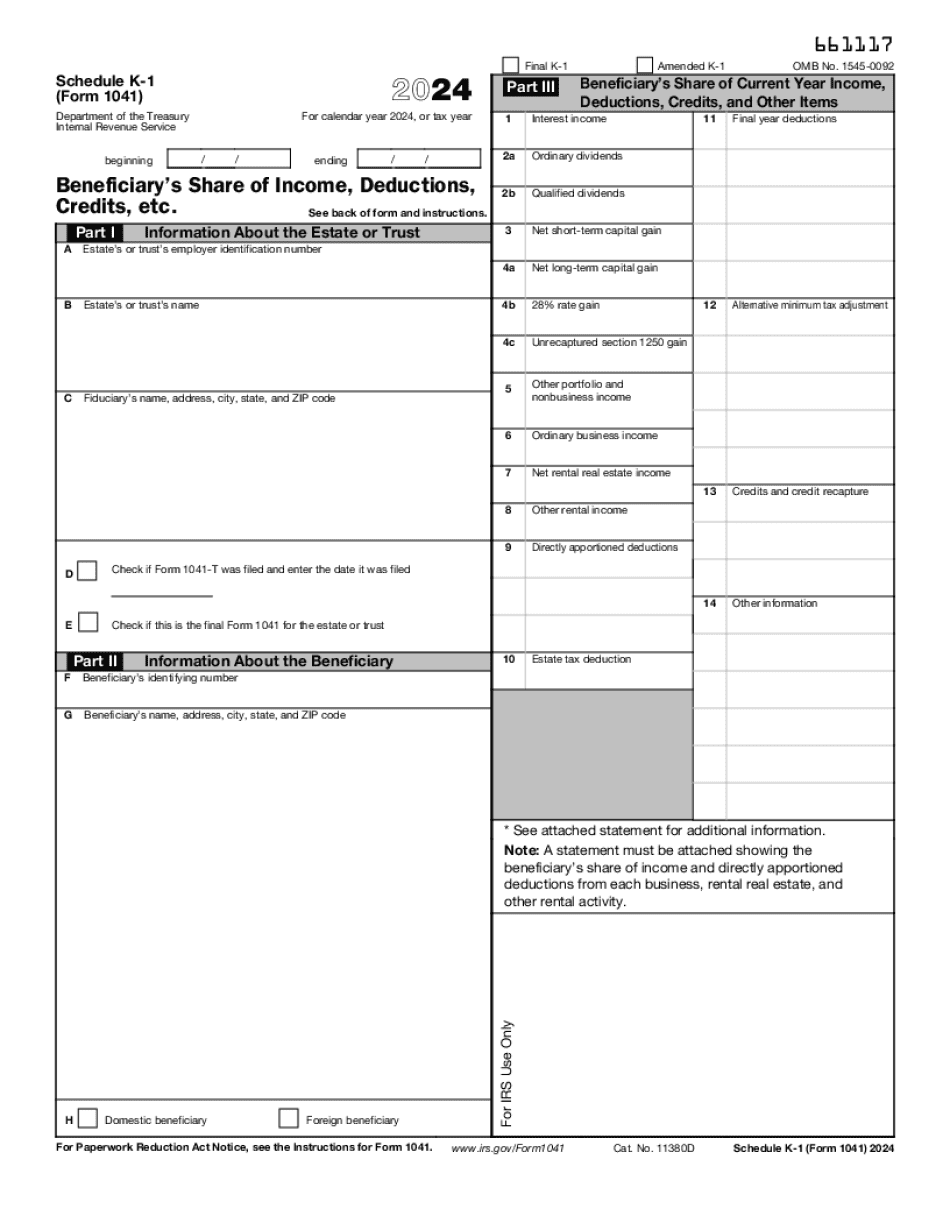

Oakland Michigan online Form 1041 (Schedule K-1): What You Should Know

The filer was appointed a guardian, fiduciary of an estate, or personal representative of a minor who is under the age of 19 (under State law, if the individual was appointed under 18 by a court or other public administrator, and all the following conditions have been met: (1) the petitioner is named as a beneficiary on the Form 11-G; (2) the petitioner signed the Form 11-G; (3) the beneficiary is under the age of 18, (4) the beneficiary is a resident of the State of Maryland, and (5) the form filed for the tax year includes a certification from the Commissioner that the beneficiary has an adjusted gross income of at least 150,000 or under 2101 Schedule K-1 Fiduciary- State of Maryland Schedule F K-1: Schedule to be filed by a Person Deduced as an Attorney Form 1041. Fiduciary — State of Maryland Schedule F K-1-0209-C: Schedules to be filed by Beneficiaries of Fiduciary-State of Maryland In order for a party to be a “Fiduciary,” the estate or trust filing the Form 1040 or Form 1040-S must list the Fiduciary as “Attorney-at-Law.” There are certain exceptions which may allow a trustee, or the filer of the Forms 1040 or 1040-S, to be an “attorney-at-law” as long as these exceptions are met. These exceptions are discussed below. (1) The filer has taken all reasonable steps to establish an attorney-at-law identity on all returns and statements filed with the Department of Taxation. (2) The filer certifies that the attorney-at-law has an active and active business as an attorney of record and is not required to act for the filer as a fiduciary. (3) The filer is represented in the office of the attorney-at-law under the laws of Maryland and, as a result, acts in his or her personal capacity in connection or participation with the attorney-at-law's business interests.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Oakland Michigan online Form 1041 (Schedule K-1), keep away from glitches and furnish it inside a timely method:

How to complete a Oakland Michigan online Form 1041 (Schedule K-1)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Oakland Michigan online Form 1041 (Schedule K-1) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Oakland Michigan online Form 1041 (Schedule K-1) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.