Award-winning PDF software

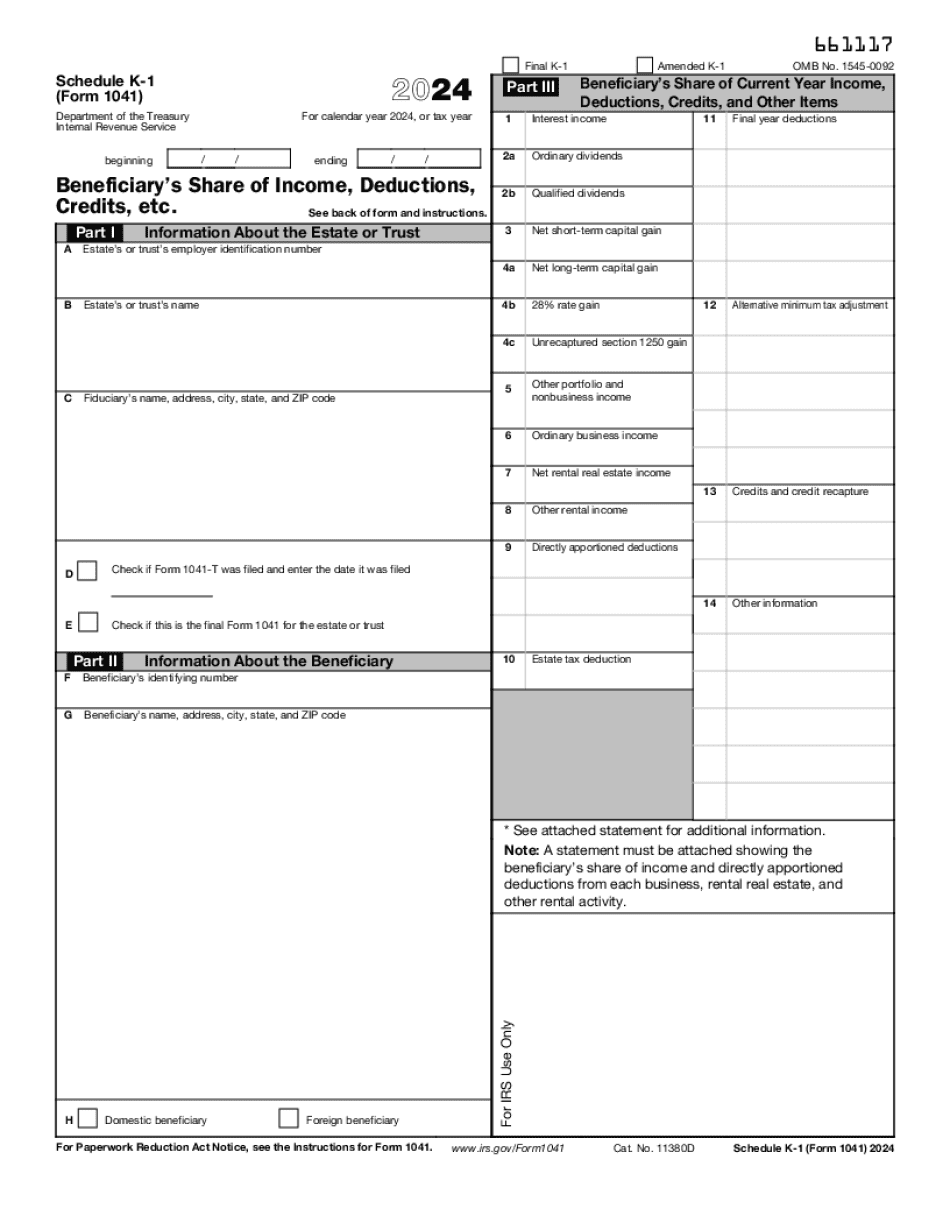

Travis Texas Form 1041 (Schedule K-1): What You Should Know

C.R. COUNT. If the estate is liquidating, the beneficiaries must pay all expenses before distributing to the fiduciary. (2) If the estate is winding up, the beneficiaries may take all amounts remaining from the estate out of the estate on payment, before the beneficiaries pay the estate debts. (3) The executor must pay in accordance with the distribution rules for all the beneficiaries. P.O. BOX 170198. Houston, Texas 77. The following are the pertinent provisions of IRC Section 6001: (G1) No person shall fail to furnish to the IRS, within ninety days of the filing or due date thereof for a certificate of designation of a surviving spouse or surviving spouse's estate, any required information required to be furnished in connection with a certificate of designation of any separate trust described in section 6011. A failure to give such information within such period is punishable under section 6015 or 6012. (G2) A person who furnishes or fails to furnish a certificate of designation of a surviving spouse or surviving spouse's estate, to the extent that such failure or furnishing has been prohibited by section 6001(e)(3)(C)(i), shall be required to pay a penalty under either the following provisions of chapter 77 of title 26: (i) sections 7701 and 7701-1; (ii) § 7701-2(b)(2), 7701-2(d), 7701-23, 7701-26, and 7701-27. (i) For failure of the person required by § 7701-2(b)(2) to furnish the information required by paragraph (b) of this section, the person is liable to the person specified in subparagraph (iii) of this paragraph for a penalty computed as follows: (A) For each failure in a reportable transaction of an aggregate amount of 25,000 or more in the aggregate during a calendar year, the total amount determined by multiplying the dollar amount of the reportable transaction by .1; (B) For each failure in a reportable transaction exceeding 25,000 in the aggregate during a calendar year, the number of the reportable transactions multiplied by .01; and (C) For each failure in a reportable transaction at or above 25,000 in the aggregate during a calendar year, the dollar amount of the reportable transaction multiplied.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Travis Texas Form 1041 (Schedule K-1), keep away from glitches and furnish it inside a timely method:

How to complete a Travis Texas Form 1041 (Schedule K-1)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Travis Texas Form 1041 (Schedule K-1) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Travis Texas Form 1041 (Schedule K-1) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.