Award-winning PDF software

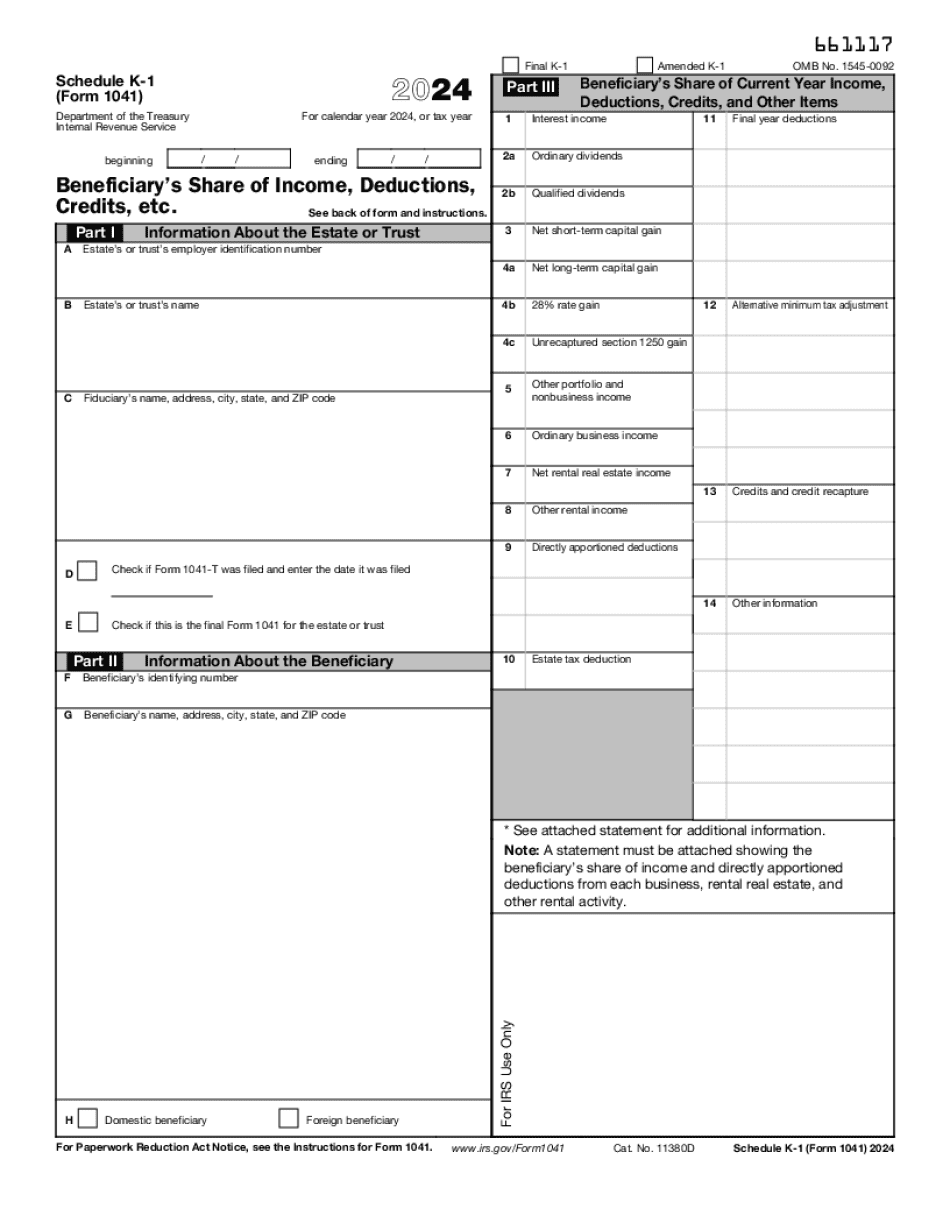

Miami Gardens Florida Form 1041 (Schedule K-1): What You Should Know

Gay has filed numerous federal and state tax returns, both for individual and corporate tax filers. The complaint also alleges that Gay and other individuals who own business entities in the Miami Gardens area have been using the name of The Tax Doctor LLC as a means for them to avoid certain state and local tax laws and regulations. Gay and “Anonymous” also make and sell tax-exempt products and services, including tax preparation, and are responsible for over 40 million in annual sales. [...] Gay and the others allegedly operate as tax preparers for individuals, who in turn file return with the state and local governments, usually through the IRS. [...] In June 2018, the Department of Justice filed two charges against Gay and “Anonymous,” alleging that they have unlawfully provided services that fail to be licensed to prepare state and local income tax returns as well as for failing to keep proper records. The two individuals face a fine and up to 10 years of imprisonment if found guilty of the charges. Filed: Feb 23, 2021 Filed (in progress): Feb 23, 2021 Florida Tax Return Preparer Charged With Tax Fraud April 23, 2023 A 20-year-old tax preparer from Miami, Florida, has been arrested and charged with filing more than 100 fraudulent tax returns. Joseph T. Gay, Jr., who goes by Joe T. Gay, has admitted to participating in the scheme, and has been charged with a total of 93 criminal counts involving income tax returns filed between April 2025 and February 2017. [...] According to [the complaint] filed in federal court in Miami, Miami-Dade, and Broward Counties, Gay admitted to participating in the scheme to file fraudulent income tax returns. According to the complaint, Gay admitted to falsifying income tax returns for his business, as well as the identity of his clients and the amount of personal income for which they had paid him. [...] According to the complaint, Gay also admitted to having the ability to make the tax returns he filed appear to be “fictitious.” Filed: April 23, 2023 Filed (in progress): April 23, 2023 Filing Tax Returns for Individuals with no Business Nov 17, 2025 — Joe Gay, of Miami Gardens, filed an individual tax return with no business. The return was filed as an extension of time to file.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Miami Gardens Florida Form 1041 (Schedule K-1), keep away from glitches and furnish it inside a timely method:

How to complete a Miami Gardens Florida Form 1041 (Schedule K-1)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Miami Gardens Florida Form 1041 (Schedule K-1) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Miami Gardens Florida Form 1041 (Schedule K-1) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.