Award-winning PDF software

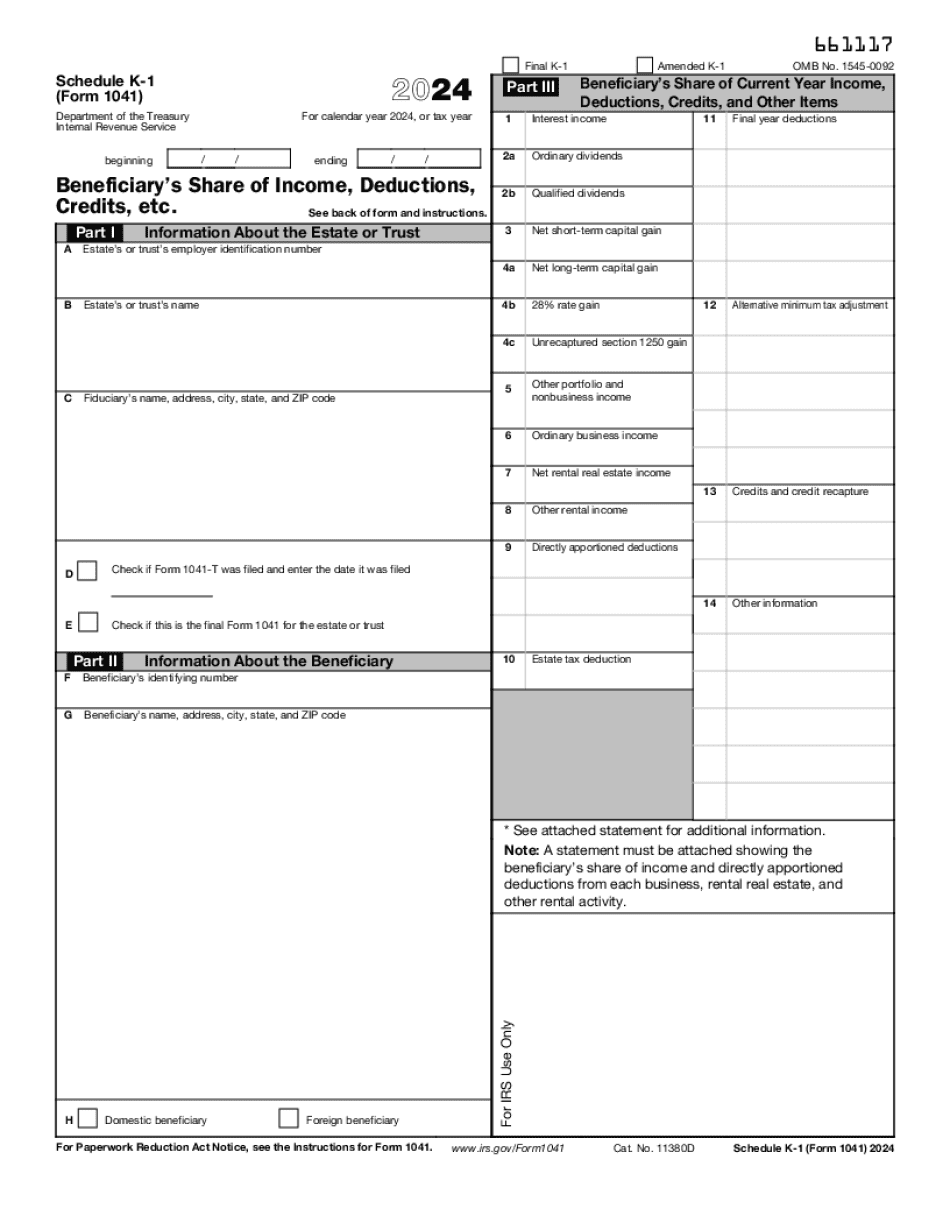

Printable Form 1041 (Schedule K-1) San Angelo Texas: What You Should Know

Form 1041 : You must file Form 1041 if you're the “named beneficiary.” In this case, the beneficiary must be the person designated to receive Schedule K-1 at your death. Note that if you don't designate anyone to receive Schedule K-1, the estate will do so. Note : If your child will be the named beneficiary, the child will be the only one to file a 1041. The child is treated as the “named beneficiary” throughout the tax year until the child reaches age 19 or reaches the age of majority, whichever comes first. In the case of joint filers, if only one filer has the trust or estates with him or her, the filer must file as the “named beneficiary.” For details, see the instructions for the Form 1041 for the 541, Beneficiary's Share of Income (Form 1041), (2021) Also, if an estate or trust that qualifies as a pass-through entity has any stock dividend and any capital gain on the sale or exchange of any assets during the year, the estate or trust must file a Schedule K-1 (Form 1041) for each shareholder or partner to report the gain as a business dividend. If the estate or trust doesn't qualify for a pass-through entity, the executor of the estate or trustee of the trust must file a Schedule K-1 (Form 1041) for each beneficiary to report the gain as a capital gain. Who is the executor of the estate or trustee of the trust? Your executor or your trustee is the individual or the entity that acts as the legal representative, agent, manager, owner, or manager, including any trust or estate organization or limited liability company, responsible for the administration of the estate or trust. Note : A fiduciary is any individual, corporation, firm and partnership who acts in an “interested” manner, such as representing the estate as an agent for the benefit of an individual, individual employee, or a party in interest in any legal proceeding. A fiduciary may also have a role in the planning and preparation of an estate plan. Your executor must be identified on the income tax return for the estate or trust for the year the pass-through entity is created. If the executor and the estate or trust are separate and unrelated, then the executor for the estate (your attorney if the estate has a will) generally must file a separate Schedule K-1 (Form 1041) or 1040-C.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1041 (Schedule K-1) San Angelo Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1041 (Schedule K-1) San Angelo Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1041 (Schedule K-1) San Angelo Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1041 (Schedule K-1) San Angelo Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.