Award-winning PDF software

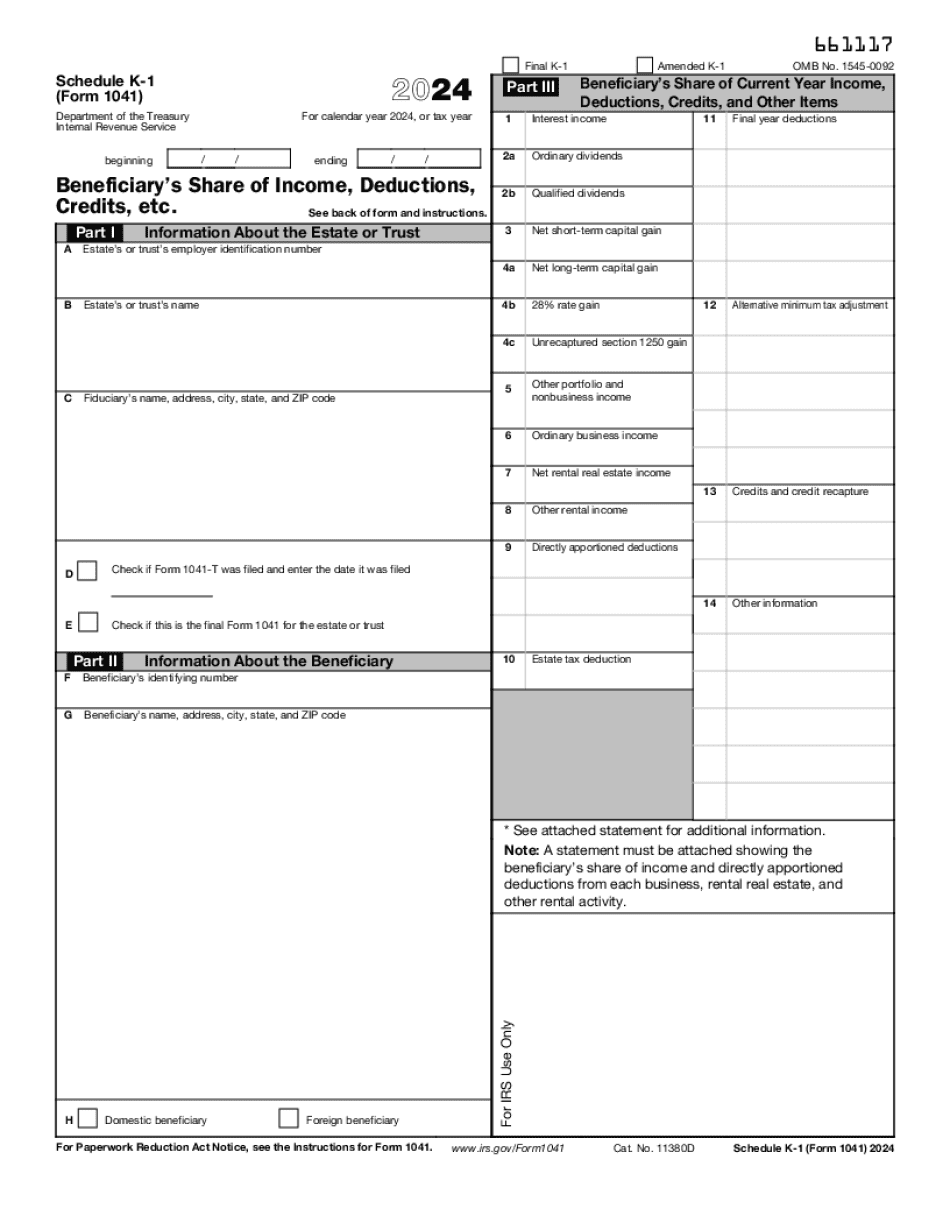

Manchester New Hampshire online Form 1041 (Schedule K-1): What You Should Know

This income would be subject to income tax withheld by the beneficiary (see chapter 15). If a trust or estate has assets of any kind, a tax form is not required. IRS Form 1096 and Schedule H Apr 20, 2025 — Form 1096, “Summary of Itemized Deductions” and Schedule H, “Hardship Income Allowance”. Schedule H provides relief for persons who are able to have their hardship income reduced to zero. . . This Schedule provides for the calculation of the value of all personal property owned by the taxpayer. It also provides for the reduction of certain miscellaneous itemized deductions. It provides for a reduction or elimination of all non-itemized deductions. A deduction for interest, dividends, annuities, and rental properties that is in excess of the amount that could be claimed without reduction. . . (see chapter 1, paragraphs 6-15) for a discussion on itemized deductions). 3/19/2018 (v1.1) Form 1098 If an annuity contract has a death benefit, the income received by the life insurance company at the time the contract is payable must be reported on Form 1098 to report the death benefit, and on a Schedule D. 2018 HRS For a joint return, there is no need to complete Form 1040 by April 15. Both spouses are expected to file their 2025 income tax return on or before April 15 of the tax year following an adoption. However, if one spouse dies, the surviving spouse must file and pay the death tax under both the standard schedule A and Schedule J for the death tax year. For a joint return, if it is estimated that there is no tax liability and the surviving partner receives the annuity payments for the death tax year, the surviving partner must file a return as if it was a joint return and pay the death tax. If the payment is made, file Form 1040X. IRS Schedule K-1 for income from retirement plans and accounts The income from IRAs, 401(k) plans, and individual retirement accounts (IRAs and 401(k)) not reported on Schedule M, line 4. (Form 1065) are to be reported on Schedule K-1 by April 15 of a calendar year. You must pay the 10-percent additional tax on the income reported on Schedule K-1. The 10-percent additional tax may be due during a calendar year but not during a particular month or even within a quarter or less than a calendar quarter.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Manchester New Hampshire online Form 1041 (Schedule K-1), keep away from glitches and furnish it inside a timely method:

How to complete a Manchester New Hampshire online Form 1041 (Schedule K-1)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Manchester New Hampshire online Form 1041 (Schedule K-1) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Manchester New Hampshire online Form 1041 (Schedule K-1) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.