Award-winning PDF software

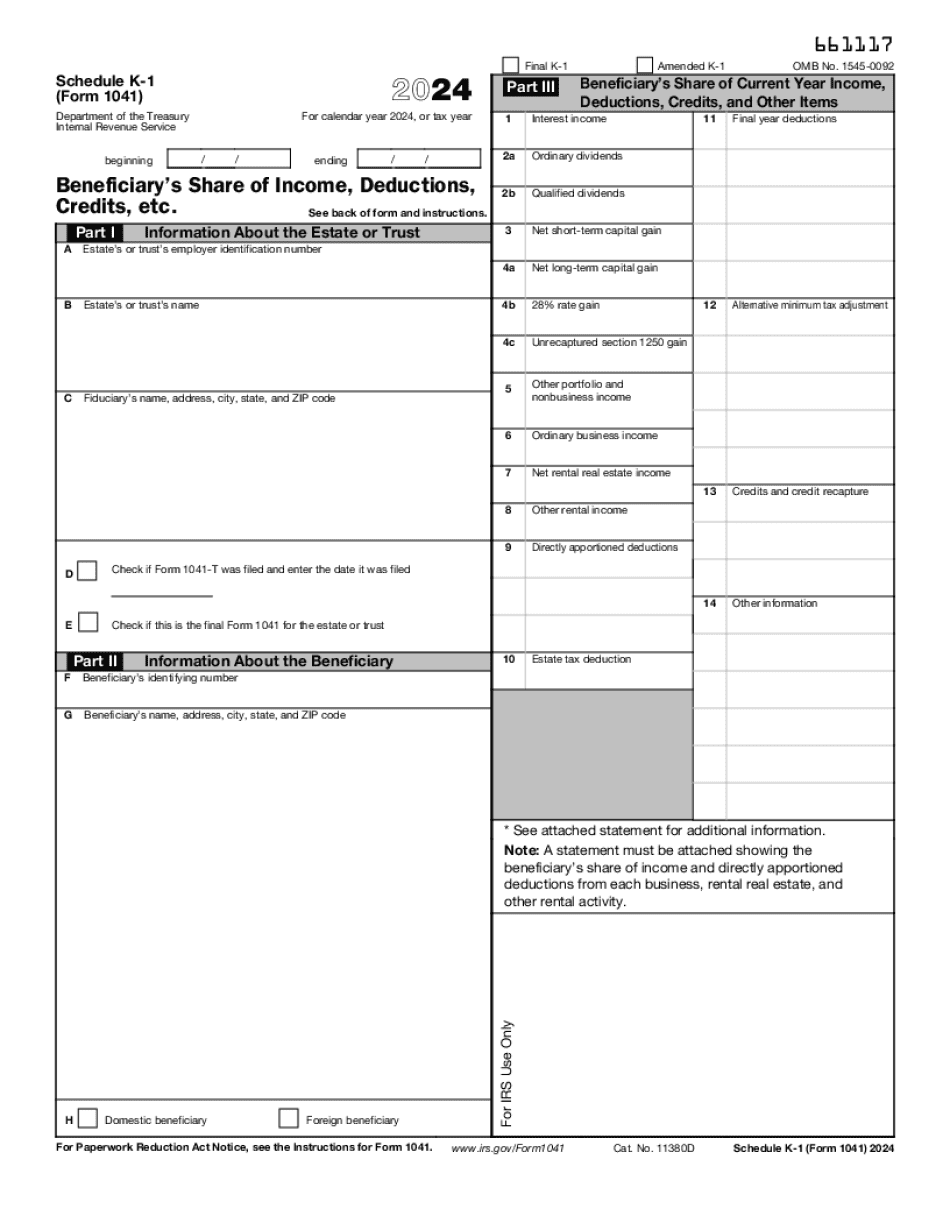

Murfreesboro Tennessee Form 1041 (Schedule K-1): What You Should Know

Sep 28, 2025 — Please sign and share the U.S. Income Tax Return for the qualified trust. Nov 14, 2025 — Thank you so much for comments. They were reviewed and considered and the comments will be accepted until October 31, 2023. 12.6.13.2.2 (04-24-2018) Estate Planning for Certain Businesses and Corporations — Business Expenses (Form 1040-PATI) The general rule is that if you own a taxable business, any business expenses are deductible as business expenses for tax year 2025 regardless of whether the business qualifies for the “pass through” allowance for the business. This also applies to a corporation; however, if the taxpayer is a member of a C corporation, you are limited to deducting only the shareholder's share of the corporation's operating expense allocations. If the corporation is a sole proprietorship, any business expenses that the individual business entity incurs on behalf of its owners are deductible as personal expenses. As a general rule, if business expenses are paid on your behalf, and there are no other allowable deductions for the business, the amount of the business expenses is non-deductible. This section provides a detailed explanation and analysis of deductions allowable for certain business expenses to help ensure your deductions for business expenses on your return are as effective as possible. The rules regarding business expenses differ. Generally, you deduct “ordinary and necessary” expenses for the services you perform in connection with doing business in excess of what would be considered ordinary and necessary under all other circumstances. However, the facts and circumstances do not always dictate what type of expenses are “ordinary and necessary” if they do not incur expenses that could not be considered “expenses of doing business” under all other circumstances. Example 3: A business owner employs 30,000 of services every year. These services are required by law and would amount to 5,000 of expenses for the business owner and 2,000 for the IRS if the business owner were to be a sole proprietor operating independently. Ordinary and necessary may indicate that the 3,000 of fees for each of the business entities need not be treated as business expenses. However, a few of the services involve regular, substantial overtime. Example 3: A commercial business owner employs 30,000 of services every year. Such operations would amount to 6,000 of expenses if the owner were a sole proprietor.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Murfreesboro Tennessee Form 1041 (Schedule K-1), keep away from glitches and furnish it inside a timely method:

How to complete a Murfreesboro Tennessee Form 1041 (Schedule K-1)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Murfreesboro Tennessee Form 1041 (Schedule K-1) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Murfreesboro Tennessee Form 1041 (Schedule K-1) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.