Award-winning PDF software

Form 1041 (Schedule K-1) Jurupa Valley California: What You Should Know

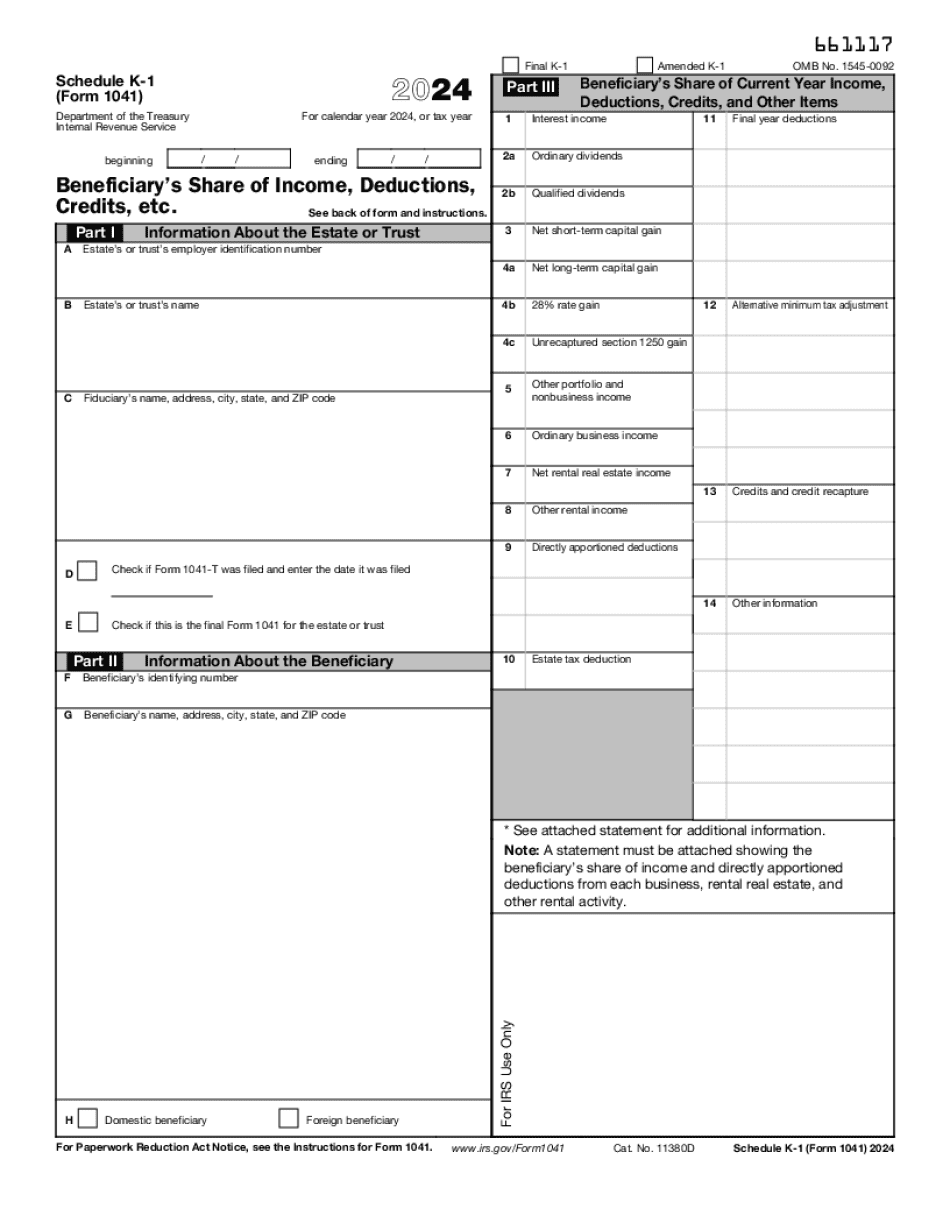

K-1 form every year that you are filing one. This is only a change from the prior tax year. However, the form may appear different at the time of filing. Is there a difference between Form 1040 and K-1 Form? If you are not sure. Look over the first paragraph of this IRS page of tax forms and schedules. What's the difference between Schedule K-1, K-1A, and Schedule C? Schedule K-1: Income and Deductions. Schedule K-1A(541): Income and Deductions, Schedule A-1. Note: Tax return information must also be attached showing the beneficiaries' share of income and directly apportioned deductions from each business, rental real estate, and. What income must be reported on Schedule K-1? You must report all income which is directly attributable to a qualified charity, if it can be shown that this income is from activities which can be taxed as charity income under Section 501(c) (3). Example 1. In 2018, you are a limited liability company (LLC) with no employees or investors. You are active and engaged in the business of creating and selling art collections and collectibles such as fine art, antique art, Oriental and Islamic art, and fine jewelry items. Example 2. In 2018, you are the managing director of a company which holds various properties in multiple states at one office in a corporate relocation. Each state's tax jurisdiction has its own rules on charitable donations, however, in most instances those regulations apply to charitable donations to an LLC created by an individual that is not subject to taxation by their state or local government. The LLC is treated as a separate entity under applicable state law. Therefore, as a tax-exempt entity, the LLC must list charitable contributions which can qualify as charitable contributions. The amount attributable to this property transferred to you on your 2025 Federal Form 1040 may be considered a charity item transferred or an expense by you on your 2025 Federal Form 1090. The amount will be reported on the Schedule K-1, Line 20-3. You must itemize all income when using Form 1040. You do not have to itemize any deductions on the Schedule K-1.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1041 (Schedule K-1) Jurupa Valley California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1041 (Schedule K-1) Jurupa Valley California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1041 (Schedule K-1) Jurupa Valley California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1041 (Schedule K-1) Jurupa Valley California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.