Award-winning PDF software

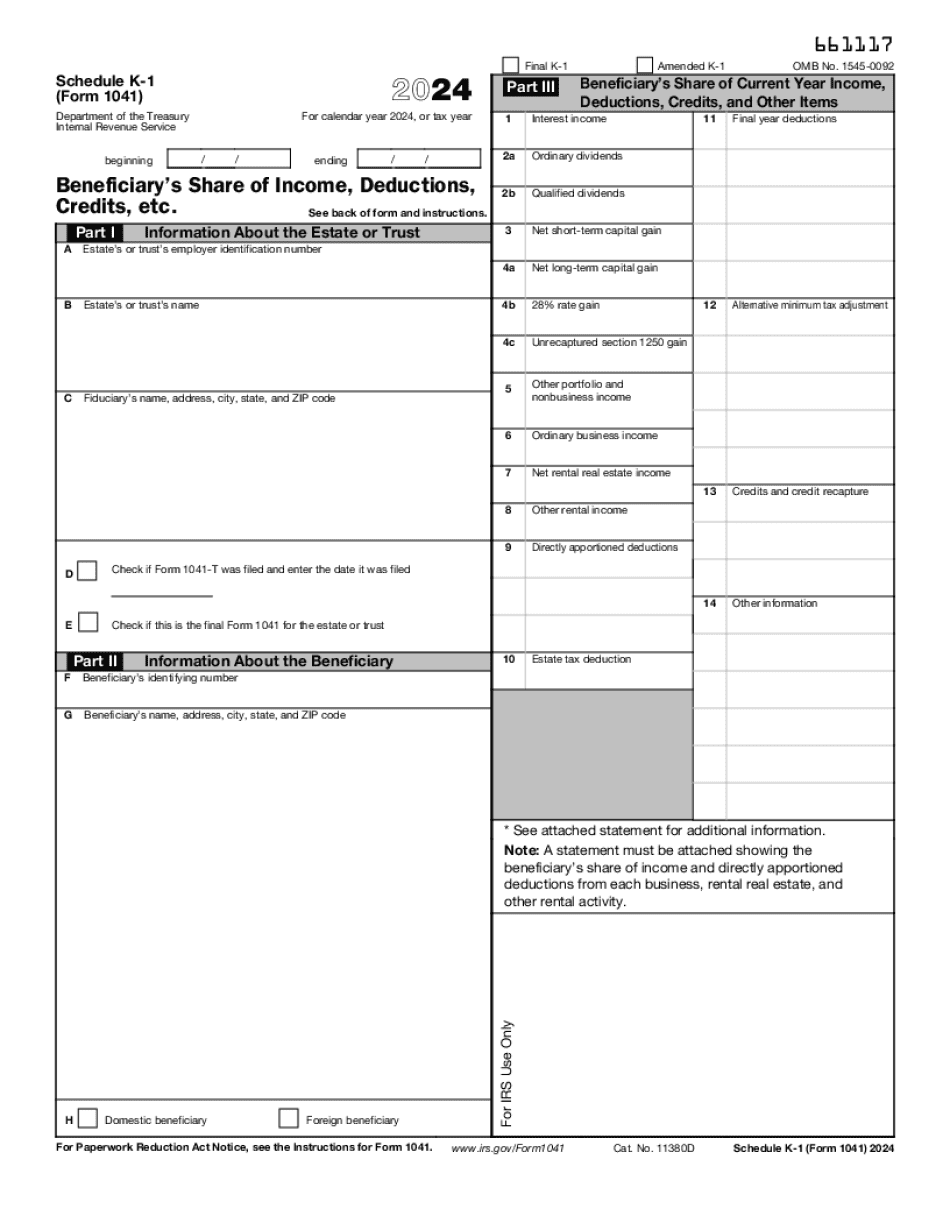

VA online Form 1041 (Schedule K-1): What You Should Know

Learn More About the 1041 Instructions and Schedules — IRS Instructions for filing Form 1040 and Schedule EK-1. (Form 1040) Instructions for Form 1040 and Schedules A, B, C, E and F. (Form 1040) A guide to filing Schedule K-1 (Form 1041) with a beneficiary's share of the estate or trust. United States Department of the Treasury. Schedule K-1 — IRS In general, a trust, unlike an estate, can be used for a wide variety of tax purposes. For tax purposes, a trust is similar to a corporation, which can take deductions and credits for its expenses. For more information on trusts see the trust fact sheet, Tax Benefits for the Trustee and Trustee's Share, available on the IRS.gov website. Apr 01, 2025 — The tax exemption for estate and gift tax is reduced to 5,000 for taxable estates in 2018. Learn more on the new estate tax rates under Senate Bill 7, which is in law and will be in effect starting in 2018. 1943 — The law of trust dates back to the end of the Civil War. It allows a person to make decisions about trusts without involving the government. A trust is similar to a corporation or partnership, but instead of using stock, a trustee uses the assets owned and controlled by the trust and the trustee's own property. 1947 — The Federal Income Tax Act (FIFA), enacted December 31, 1947, is the first federal tax law that regulates the use of trusts (other than the tax-exempt status of qualified trusts). Section 1041 of the Internal Revenue Code is the most comprehensive tax provision governing the tax-exempt status of trust income. The section applies to trusts in varying degrees and is a guide for tax planning. Inheritance Tax. The gift tax applies to individuals, not trusts. However, trusts are treated as individuals for purposes of inheritance taxes. The estate tax does not apply to trusts (except after the death of a beneficiary). The gift tax requires that an individual be alive “at the time of the event or incidents giving rise to an obligation” to pay the tax. The individual does not have to be the beneficiary of a trust and does not have to be the owner of the trust property. However, the lifetime exemption is reduced by 50 percent if the estate is subject to the gift, estate, or generation-skipping transfer tax.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete VA online Form 1041 (Schedule K-1), keep away from glitches and furnish it inside a timely method:

How to complete a VA online Form 1041 (Schedule K-1)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your VA online Form 1041 (Schedule K-1) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your VA online Form 1041 (Schedule K-1) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.