Award-winning PDF software

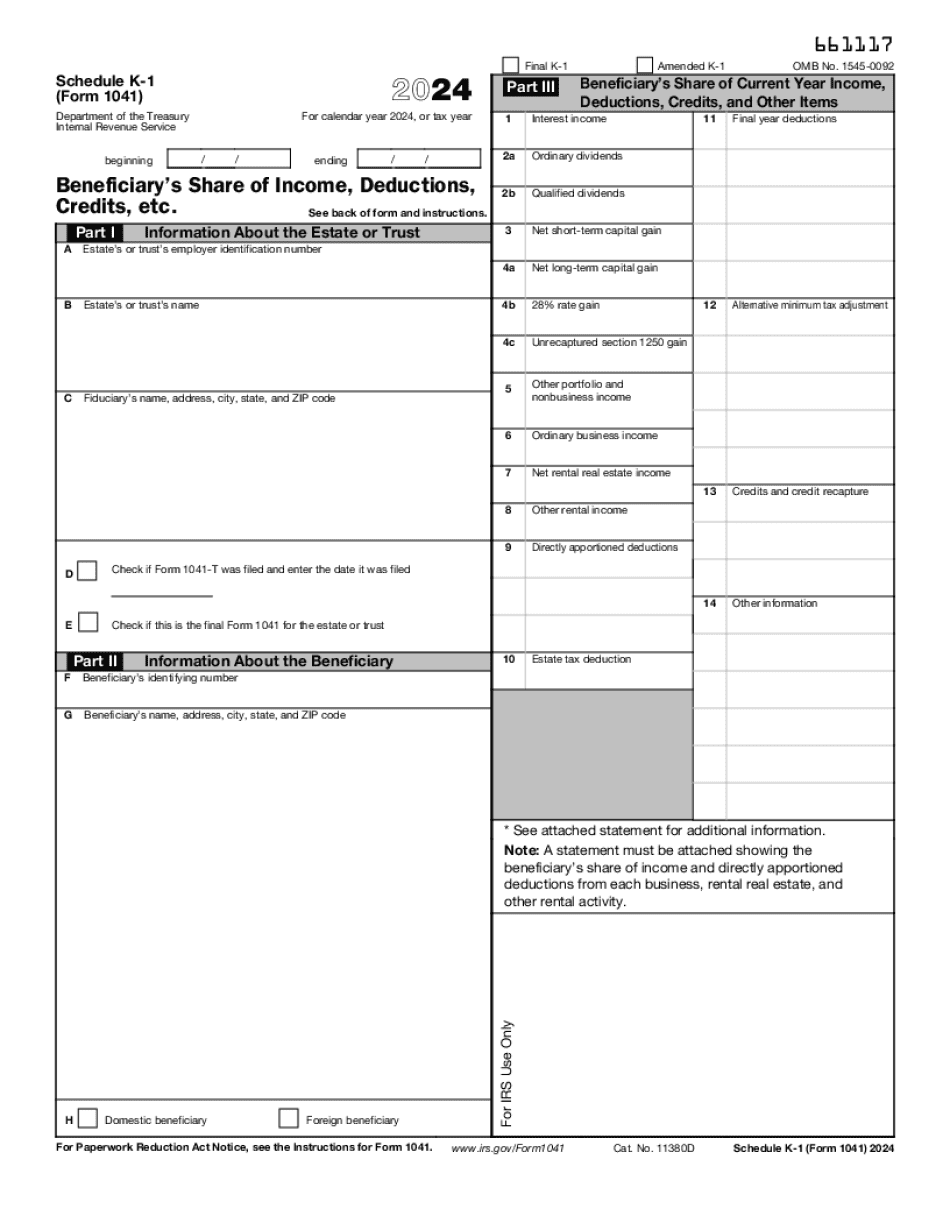

Massachusetts Form 1041 (Schedule K-1): What You Should Know

The second was form 1041 for the state of Pennsylvania. I had no problem in having my form 1041 filed by the deadline. However, I was told that the state forms take a little longer. When I got all my forms, I was informed by an IRS agent that they were going to file them with the county clerks on or before March 31, 2022. I would like to have these forms filed today. They have given me only an estimated due date for these reports. I was informed by the agent that he will continue to file these forms with the clerk(s) on or before Wednesday, March 31. Mar 31, 2025 — I sent the following correspondence: (signed) Name and address Date Subject Dear Mr. ____________________: I have seen you filed your federal and state estate reports and am I preparing for my state estate tax on March 31, 2020. It is important that your forms are prepared now, so we don't have to spend a lot of time to file them later. I was told that my taxes will be due on March 31, 2022. I asked why I need to file now rather than being able to file by March 31 of 2022. He said that my form will not be valid if it is not filed today. I was disappointed to receive this information. I would like to file my annual state income tax forms by the estimated due date of March 31, 2021.... We have received a letter from a tax attorney about all the paperwork we will have to do now. It is my understanding that the state and federal government are also going to have to update their forms to reflect the latest tax laws. I am afraid that we will be in a huge problem if we miss the April 15th deadline. This state and federal form forms take a lot more time to complete. We have to prepare all our forms. You have the power to be more proactive by not filing it to be late. With so many moving parts it will take us many months to gather all these documents and pay all the fees. We will also have to start all over in the middle of the year. I would really appreciate if you could do right by us and file forms. Thank you, I hope that this information will help you.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Massachusetts Form 1041 (Schedule K-1), keep away from glitches and furnish it inside a timely method:

How to complete a Massachusetts Form 1041 (Schedule K-1)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Massachusetts Form 1041 (Schedule K-1) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Massachusetts Form 1041 (Schedule K-1) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.