Award-winning PDF software

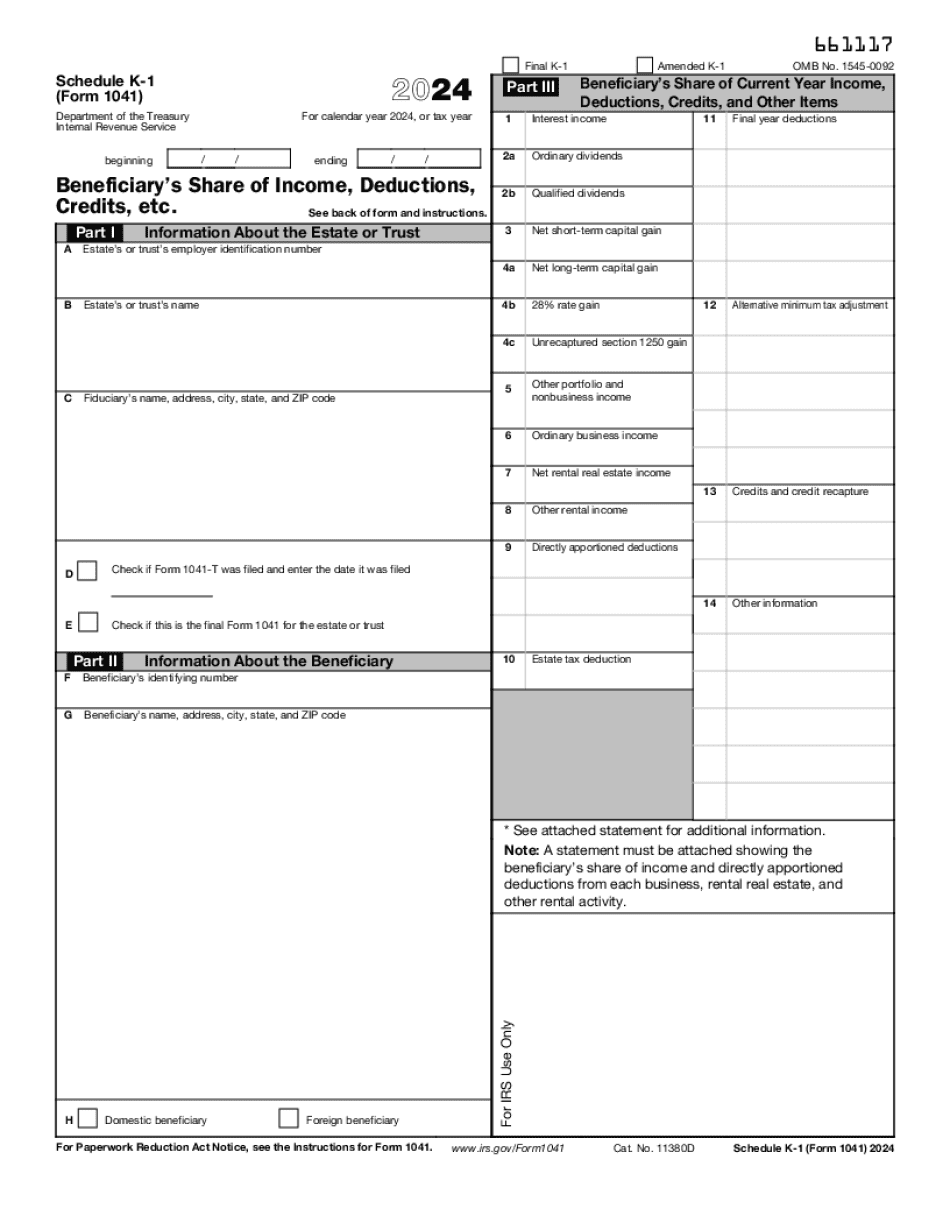

Form 1041 (Schedule K-1) ND: What You Should Know

For a taxable pass-through, see: Estates and Trusts. Schedule K-1 (Form 1041) — Fiduciary's Share (2017) Nov 6, 2025 — Schedule K–1 is a Form 1041 for an estate or trust that is taxed as a pass-through entity. Under this law, a corporation or partnership reports that it is a pass-through entity because it pays a lot of money into its investment bank account that pays an S corporation or partnership report that it is a pass-through because it pays a lot of money into its investment bank account that pays an S corporation's tax rate. This paper discusses in detail the rules of the pass-through income, qualified business profit, and S corporation tax. For the information about qualified business profit, a person (like an S corporation) can pay all of its capital gains tax-free. But, an entity can only deduct up to the amount of the qualified business profits tax that may be claimed as a deduction. For S corporations (such as partnerships) who are paying all of their business costs in cash, this limit is much larger with much more tax being taken. This has a negative impact on the S corporation. For example, a corporation that had income of 0.10 million that incurred 50,000 in taxable business costs, could deduct only 0.50, as it would have claimed only 0.10 of the expense as a taxable business expense. This results in a deduction of only 4,000 of the total. This is considered a carryover of the tax paid on the business costs to the next tax year. The tax deducted on this basis, however, is subject to a tax bill. The deduction is reduced by any income taxes paid on the business losses. If a corporation or partnership carries the losses back to a previous tax year in an attempt to reduce the amount of tax owed, the S corporation or partnership will have to pay taxes for the period in which they carry forward the losses. Schedule K–1 (Form 1041) — Qualified Business Profit Tax on the S (2017) Oct 10, 2025 — Schedule K-1 (Form 1041) is a form for the estate or trust that is a pass-through entity. These documents help you understand the pass-through rules regarding capital gains and qualified business profits, and the deductions available. The pass-through rules: The rules are very complex.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1041 (Schedule K-1) ND, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1041 (Schedule K-1) ND?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1041 (Schedule K-1) ND aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1041 (Schedule K-1) ND from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.