Award-winning PDF software

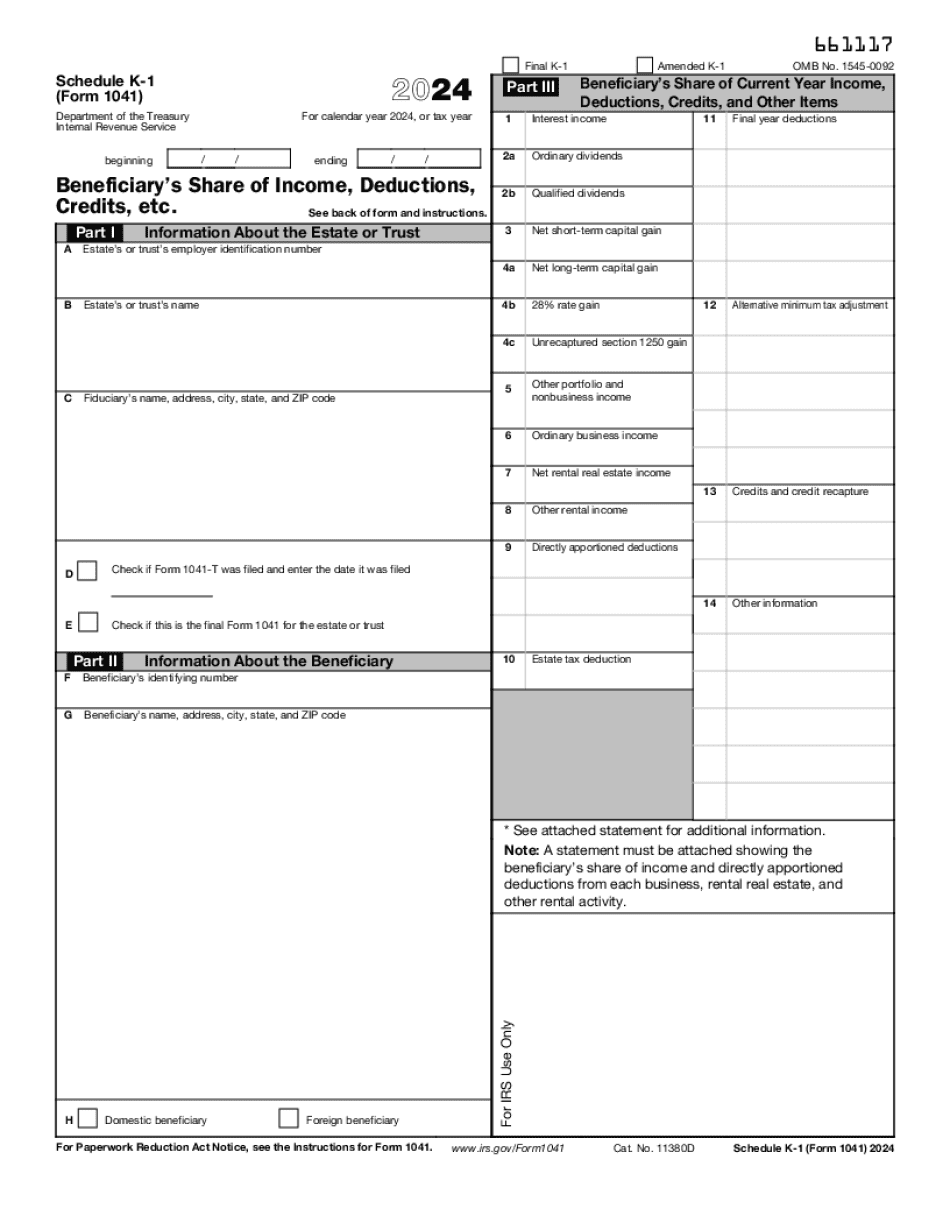

Printable Form 1041 (Schedule K-1) Westminster Colorado: What You Should Know

A joint return filed by spouses who receive an allowance for the support of their children. Child support. Credit for education expenses. Child Support Orders, (IRS tax form) for child support for those under 18 and over 18 if supporting partner(s) under 18. Child support orders do not need to be updated if the support agreement that was signed is amended or terminated. Child Support Orders for Child Support Arrears For child support arrears, please refer to the information at the state level (see the list below). Child Support Payments: For child support payments please see the instructions found on the Child Support Payments website or contact the Child Support Payments toll-free number, Child Support Arrears: For child support arrears see IRS tax form 1042 or the information in the chart below and contact the IRS Child Support Enforcement Section. Child support arrears in Alaska and Hawaii Child support awards by state Child Support Orders State Payments by state. All states including Arizona, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oregon, Pennsylvania, Rhode Island, Virginia, Washington, Delaware, West Virginia, Wisconsin, or Wyoming must fill out and include a Child Support Order for all support payments. Child Deductions state and local income and sales taxes Child and Dependent Care Expenses These are the only income tax forms that can be electronically filed and processed as a joint return. Child and dependent care expenses are generally deductible expenses regardless of their source. In cases of unusual circumstances in which support payments to the child support recipient exceed child care expenses paid, parents and/or noncustodial parents may be able to deduct up to the maximum amount that they are allowed to deduct for child support. The rules that are applicable to deductions for this type of reimbursement will vary depending upon the particular rules that are in effect for your state. The deduction rate for these type of payments and expenses is reduced or eliminated if an order for visitation is issued. Child and dependent care expenses that are not deductible by the payee will result in a credit against gross income reported on your state and local income tax return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1041 (Schedule K-1) Westminster Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1041 (Schedule K-1) Westminster Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1041 (Schedule K-1) Westminster Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1041 (Schedule K-1) Westminster Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.