Award-winning PDF software

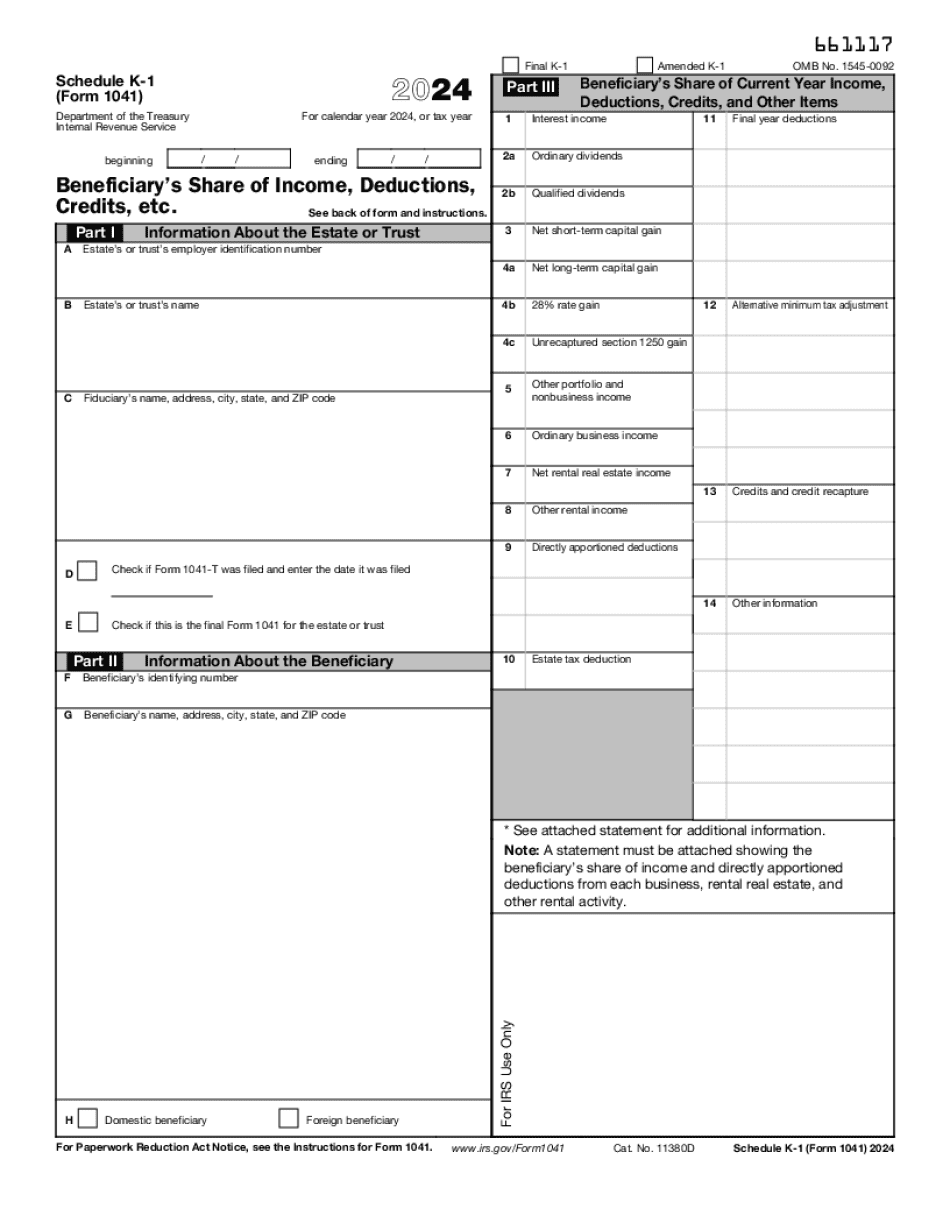

Printable Form 1041 (Schedule K-1) Oxnard California: What You Should Know

Oxnard, CA Beneficiary's Instructions for Schedule K-1 (541). Note: A statement must be attached showing the beneficiary's share of income and directly apportioned deductions from each business, rental real estate, and. Payment Instructions The Taxpayer Instructions, Tax Exempt Status and Exempt Organizations, Non-Qualified Plans, Social Security, and Medicare sections are updated regularly to reflect changes in the law and any technical issues. The Taxpayer's Guide for Individuals states who are an individual and individuals who are not taxpayers. If you use another document, contact the local IRS Tax Office where you filed your tax return directly for instructions, if required or ask the relevant information on the IRS website and/or telephone. There are special instructions for foreign bank depositors. If you would rather mail in your tax refund to a private address then use the following address. Attn: Oxnard California 4066 Foothill Road Oxnard, CA 93542 Note: For online tax returns, you can use the Electronic Federal Tax Payment System (filing), or Tax Master. If you use the system, you will have the option of submitting the return without viewing the documentation. If you need more detailed information on these or other IRS tax forms or publications to prepare your tax return, Contact your private tax professional. Do you have questions about the Income tax provisions of the California Tax code or your Tax Return? Send us your questions to, and we will try to assist you. We provide you with free access to our software, and also give you a 20 mail order certificate for tax preparation using our software, with the same advantages offered to the public. This special mail order certificate is valid for one year. A 20 fee is charged to you, after the certificate is issued. Also, you are entitled to a free copy of the California Income Tax and Franchise Tax Guidebook, Volume 1, the California Franchise Tax Guidebook, Volume 2, the California Business Tax Guidebook and various other tax guides that are required by law to be furnished to you upon request.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1041 (Schedule K-1) Oxnard California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1041 (Schedule K-1) Oxnard California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1041 (Schedule K-1) Oxnard California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1041 (Schedule K-1) Oxnard California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.