Award-winning PDF software

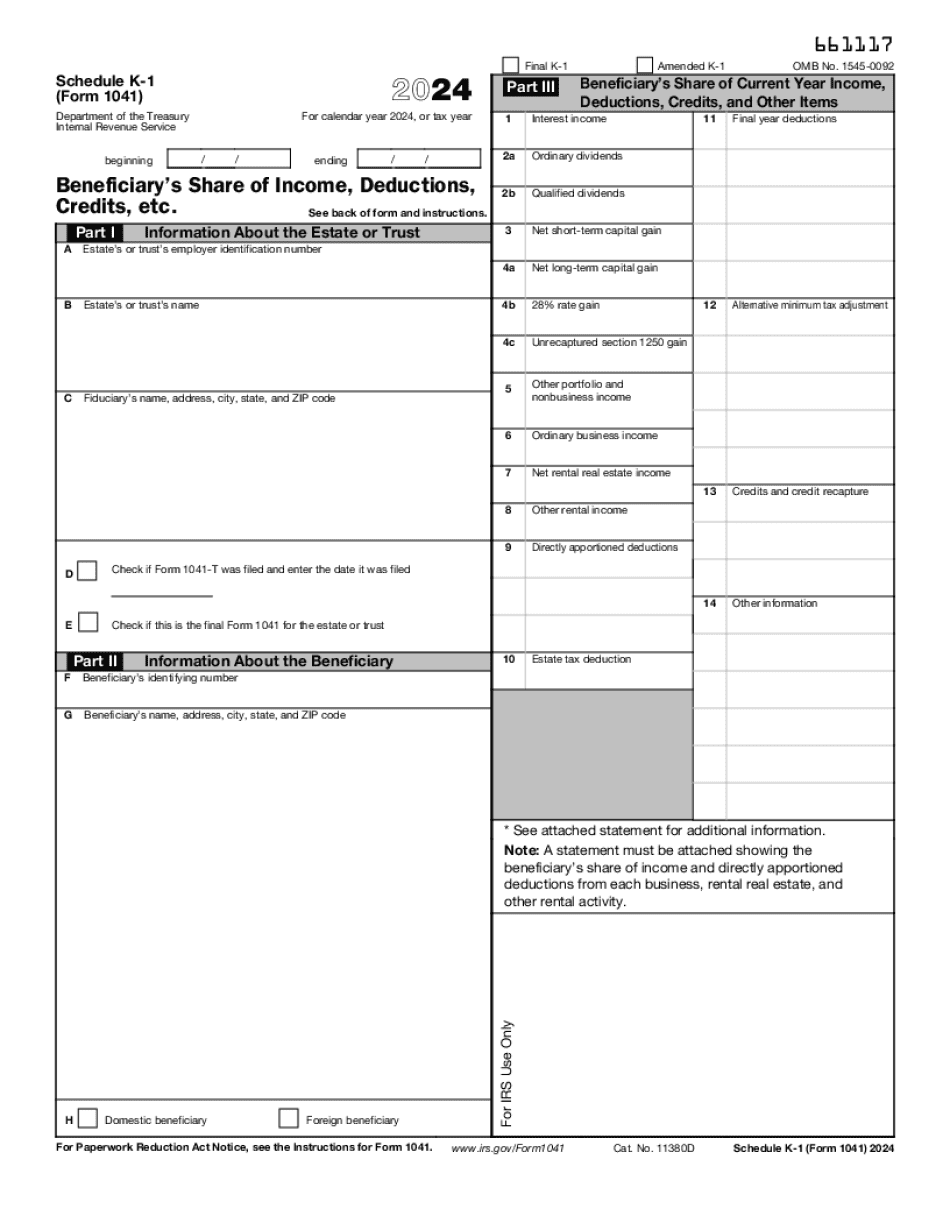

Form 1041 (Schedule K-1) online Fort Collins Colorado: What You Should Know

DR 0022 — Estate and Trust Transfer Tax Returns and Claim for Refund of Credit. DR 0106 — Declaration of Estate and Trust; Letter of Administration. DR 0108 — Certificate of Title of Trust. DR 0109 — Affidavit in Lieu of Acceptance or Release. IRS Publication 1320-B — Estate Tax Return. Pub 1320-B-3 — Estate Tax Form and Cover Page. IRA Employer's Guide, 2014. IRA Form 1099-A and IRA Form 1099-NR. IRA Publication 1274 — Income Tax on Distributions From an IRA. Pub 129— Tax on Distributions Received During a Tax Year by Certain Retirement Plans. Pub 2918 — Tax on Unearned Income (Social Security); Pub 3022—Tax on Depreciation and Amortization of Property; Pub 3101—Residence Tax; Pub 3106—Pregnancy Discrimination. Pub 3112—Child and Dependent Care Expenses. Pub 2801—Tax on Educational Savings Plans. Pub 2856—Tax on Taxable Annuities. Pub 3863—Tax on Retirement Annuities. Pub 3864—Tax on Retirement Interests of Employee Plans. Pub 3865—Tax on Interests Paid to the Plan. Pub 3868—Tax on Dividends Received from a Roth IRA. Pub 3869—Tax on Dividends Received from a Traditional IRAs. Pub 3873—Tax on Dividends From Qualified Plans. Pub 3894—Tax on Qualified Plans Dividends. Pub 4061—Tax on Employee Insurance Benefits. Pub 4062—Tax on Employee Plans' Distributions; Election of Qualifying Plan Distributions. Pub 4065—Tax on Employee Plans'; Election of Qualifying Plan Distributions (continued). Pub 4068—Tax on Long-Term Disability Benefits. Forms and Publications — Brock and Company CPA's PC Click a publication to view it online. Tax Glossary. Tax Glossary. TaxExpendibles. IR8201 (U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1041 (Schedule K-1) online Fort Collins Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1041 (Schedule K-1) online Fort Collins Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1041 (Schedule K-1) online Fort Collins Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1041 (Schedule K-1) online Fort Collins Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.