Award-winning PDF software

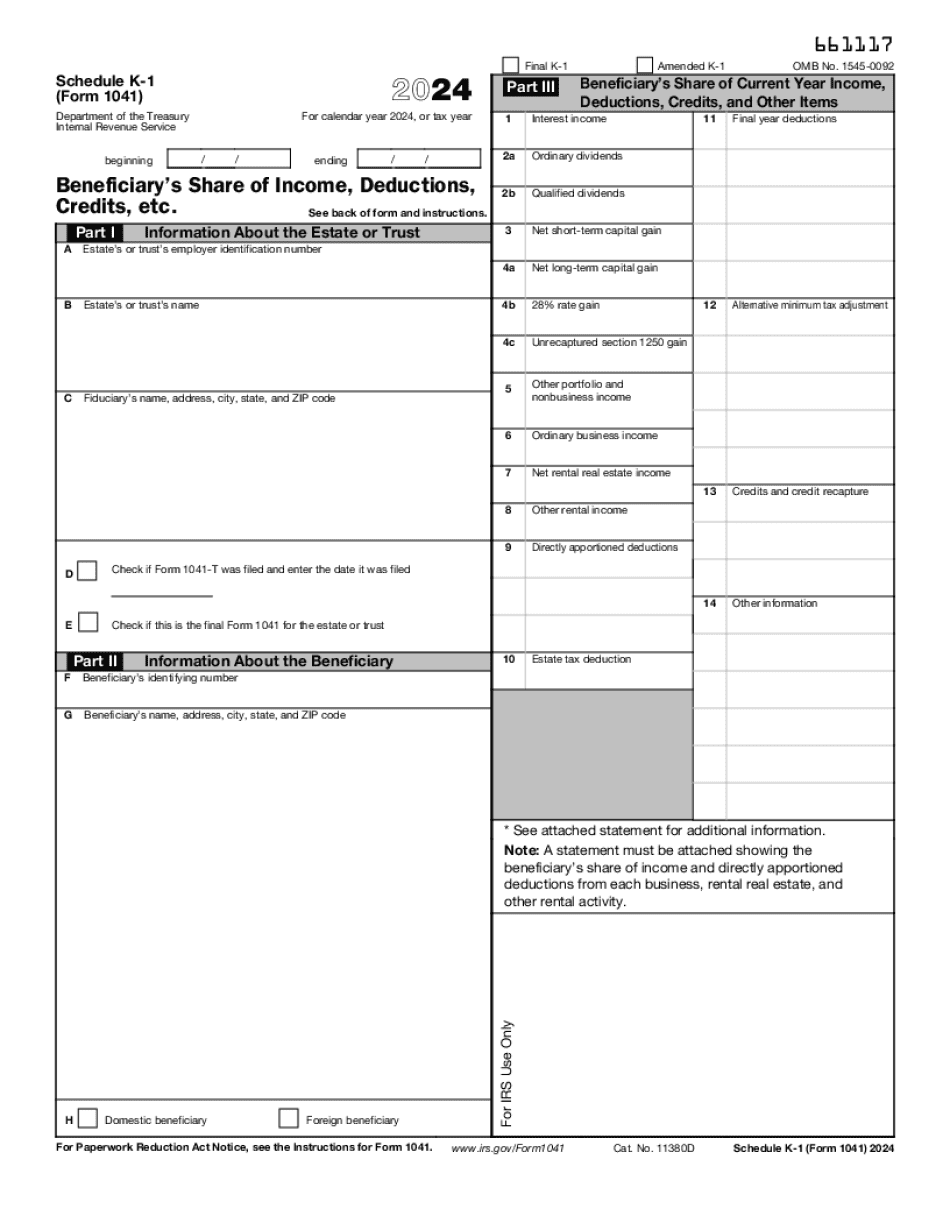

Form 1041 (Schedule K-1) for Syracuse New York: What You Should Know

For your beneficiary to claim their share of the income tax deduction, the reporting schedule, the forms it's filed under, and the tax form itself. Note that the IRS and the IRS have been clear in that income tax reporting schedule are to be used only to report on the estate, not to provide income tax information to individuals (at least not in 2025 until Congress updates the regulations). The most complete discussion of your fiduciary duties to a beneficiary from the IRS is found at IRS Notice 2016-53 You must treat a personal representative the same as you would treat a trustee in the event of a qualified personnel representative's death. Your personal representative must report the beneficiary's income, tax-free and without deductions, on the form unless a provision for a different treatment specifically applies. A beneficiary's reported income is used to determine the estate or trust taxable estate. The IRS has the exclusive right to determine the beneficiary's share (whether the beneficiary pays or receives) of the estate tax deduction. The same rules apply to any transfer or exchange of property that occurs after the beneficiary dies. If you are a taxpayer whose spouse is a personal representative, you should get written instructions regarding whether your spouse should use the reporting schedule or whether to submit the form as a substitute for the reporting schedule. For instructions on how the reporting schedule is to be used, please refer to IRS Publication 549 and “How to Use the Reporting Schedule in Certain Cases.” For more information, or to file an extension, visit the IRS.gov website at or contact your local IRS tax office. To schedule an appointment with your local IRS tax office, call (TDD/TTY-). This website may be accessed through the IRS Virtual Tax Assistant tool at . You can read more here: Form 941, U.S.-Related Entity 941, and Form 2555. Schedule K-1, Estate and Gift Expenses Apr 24, 2025 — Form 1040 for a U.S. citizen or permanent resident (green card holder) who dies, including a Form 1040-EZ may be filed on behalf of dependent children not yet 21 years of age. A beneficiary's Form 1040 is not required if there is no one living who is the beneficiary. You must designate a recipient or payer.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1041 (Schedule K-1) for Syracuse New York, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1041 (Schedule K-1) for Syracuse New York?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1041 (Schedule K-1) for Syracuse New York aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1041 (Schedule K-1) for Syracuse New York from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.