Award-winning PDF software

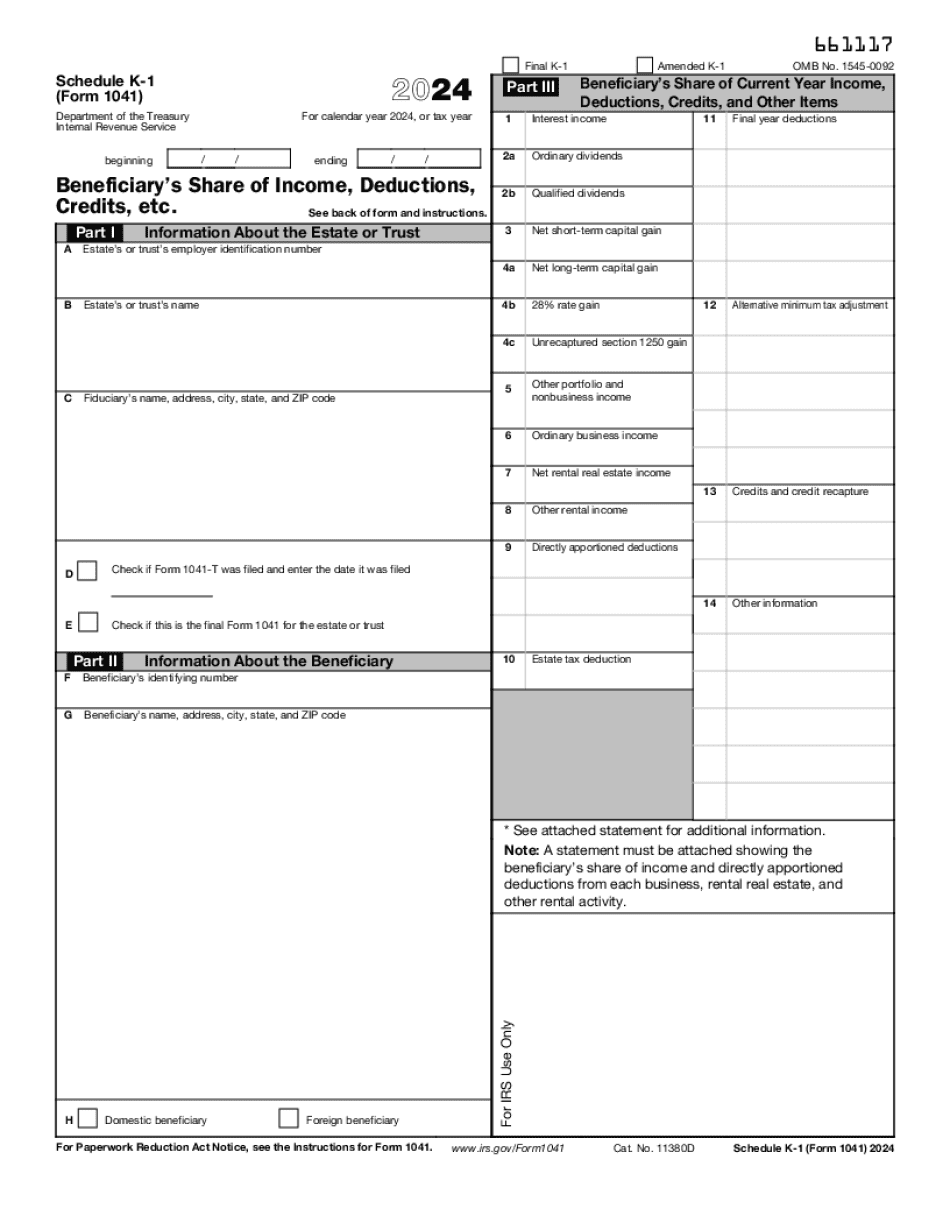

Aurora Colorado online Form 1041 (Schedule K-1): What You Should Know

Tax Division 303.739.7800 The Department of Revenue (FOR) is the tax enforcement agency for the City of Aurora. The department's mission is to administer and enforce the tax laws in the City of Aurora and to create a uniform system of collection and payment of property tax. The department's resources include, but are not limited to: the Denver Metropolitan Police Department (detectives), the Denver Police Department (officers), tax assessors, municipal property appraisal companies and tax assessor assistants. FOR also has a partnership with the Colorado Department of Public Health and Environment to offer the first of its kind “community health assessment” system to all the cities and townships in Aurora. It is an effort to identify, collect and process health records from Aurora residents for community screening. FOR believes that all residents are valued by being healthy and that the City recognizes the importance of health status. FOR also recognizes that individuals, families and communities are vulnerable at times. To address this, FOR has established an Active Behavioral Health Program that works collaboratively with the Denver Health Department, community, and the Department of Public Health and Environment to address behavioral health care needs in the community. The program was developed to better support individuals, families and communities. FOR has a comprehensive system in place to assess tax liens for delinquent property tax or delinquent tax bills. You may use this application tool to request an assessment by mail, in person at the City's Tax and Collection office on Park Avenue or online by clicking on “Assessments” and selecting “Assessments for delinquent tax” from the link provided. If you are interested in applying for a tax assessment, you may fill out one of the forms below by visiting the Tax Assessor's Office located at 701 Park Avenue or by calling 303.739.7800. If you wish to use this online assessment request tool, please note, there is no cost for using this tool. We recommend that you print out the form and provide it to your tax assessor. If you cannot print the form, you may mail a copy to us by clicking on the link provided. Note: The Colorado state income tax return form must be completed and signed by your taxpayer and your tax assessor. You may check your account monthly at any time by accessing your account from the “My Account” page on the Department's Website.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Aurora Colorado online Form 1041 (Schedule K-1), keep away from glitches and furnish it inside a timely method:

How to complete a Aurora Colorado online Form 1041 (Schedule K-1)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Aurora Colorado online Form 1041 (Schedule K-1) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Aurora Colorado online Form 1041 (Schedule K-1) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.