Award-winning PDF software

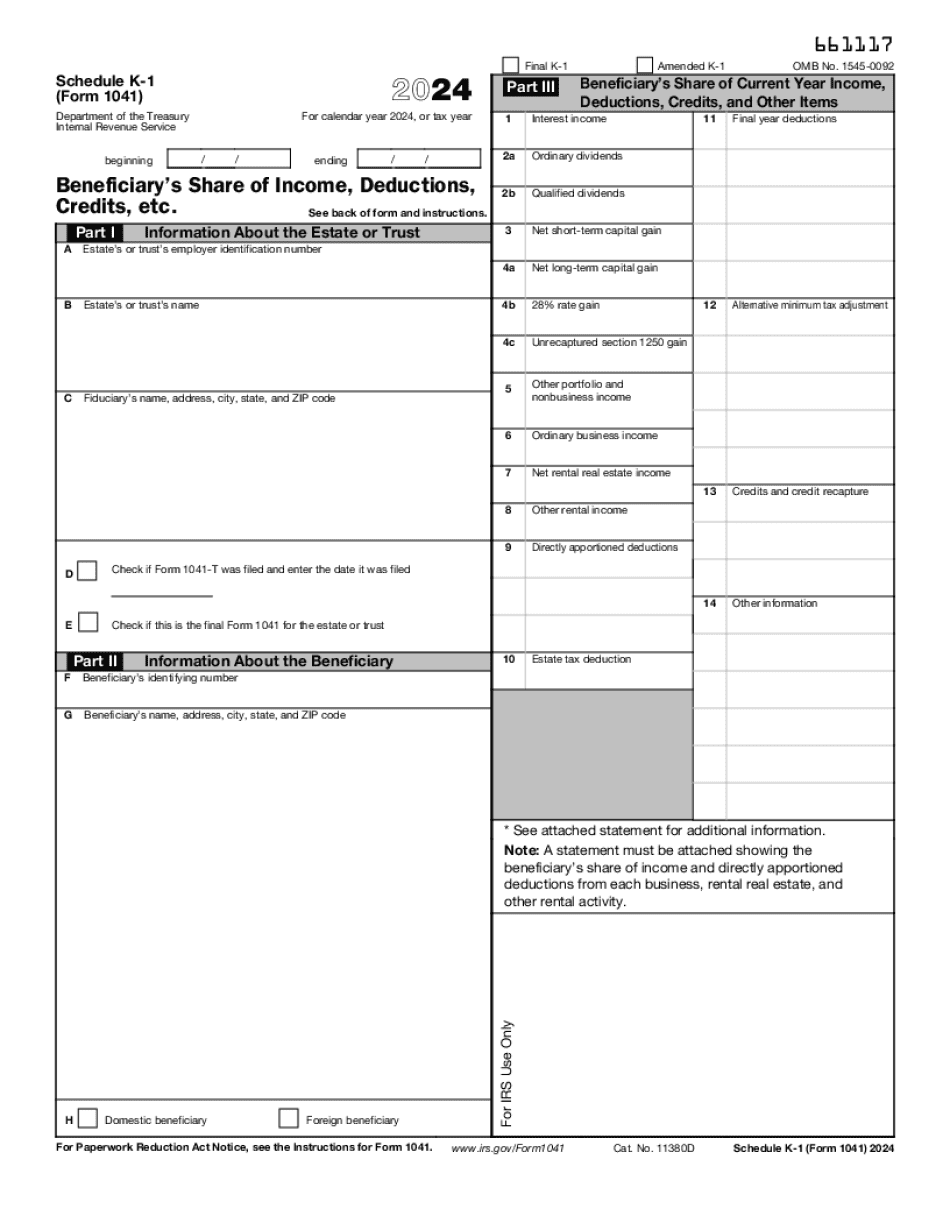

schedule k-1 (form 1041) - internal revenue service

Tax forms and instructions. Form 1041. Beneficiary's Share of Income, Deductions, Credits, etc. (1) In the case of a trust, if the beneficiary is also a non-resident alien individual, the tax is a flat 10% tax and the portion of the trust's gross income that the beneficiary would be allowed to deduct as personal income under the rules in subsection (c)(1) is not subject to those rules, other than the deduction allowed to an alien under section 108 of the Internal Revenue Code of 1986 and the deduction allowed under section 220(e) of the Internal Revenue Code of 1966 for the tax paid under section 2032. No further deduction is permitted for any amount paid or allocable to qualified long-term care services on behalf of the trust. The amount allowed to the beneficiary as a deduction under sections 108 and 220 does not count as taxable income of the trust.

About schedule k-1 (form 1041), beneficiary's share of income

Income earned on a capital gain, interest, interest earned on a credit card debt, etc., should be reported as taxable income instead of as income from sources outside the payee's foreign base. Do not include income derived from sources abroad in your Form 1040. To claim certain credits, deductions, and credits in the form you have to file, you'll need to complete a Form 1040 or 1040A Form 1040A is not for tax year 2018 if you filed a joint return. You can also get your 1040A by visiting You can get your estimated tax using your 2016-17 Form 1040, and Form 1040EZ by visiting , but if you want the most accurate information you should use 2017-18 Form 1040 or 1040A. Form 1040A has an error due to a coding error. The correct code for this form is 2017-07, instead of 2017-18 Code 15. For more information on your Form 1040, use . To file your.

What is a schedule k-1 form 1041: estates and trusts?

To do so, fill out Form 1040, 1040A or 1040EZ, or attach your 1040 (or 1040A or 1040EZ). For certain trusts or estates, Form 1041 is also available. A. Is Form 1041 available from the IRS? Yes, Form 1041 is printed on the front of each year and is available 24 hours a day, 7 days a week. The form generally requires the reporting of all assets from which you received income for the year. You may report income, or you may choose not to report income from your assets. For more information, please see the Instructions for Form 1041 available at B. Do I need to file Form 1041 if my estate or trust meets the requirements for a Certificate of Probate? Yes, you must file form 1041 in order to report the income generated by the estate or trust in the year of death. C. If a trust dies, do the assets.

Schedule k-1 (form 1041) - overview - taxslayer pro support

When used by an estate or trust, Schedule K-1 establishes the amount of a payment (the “amount due”) to be made to the trustee, and describes the services, assets and estate expenses to be deducted by the trustee from the estate or trust's income (including capital gains). Here are five important points to understand when filing Form 1041: You need to file the Schedule K-1 to the IRS. The Schedule K-1 must be filed even if you do not collect any income from the estate or trust. The Schedule K-1 must also be filed to avoid tax liability on any income you do not deduct. The Schedule K-1 must be submitted by the end of February every year. You do not have to file it yourself. However, filing it does help clarify your position in the case. The payments you make on behalf of the estate or trust must be made.

instructions for schedule k-1 (form 1041) for a beneficiary filing

See section 1604 of this title for a Beneficiary. Filing. Form 1040 (or 1040NR), Form 1040NR-EZ, or Form 1040-EZ. If a person is a beneficiary or designated beneficiary of an employee benefit plan or governmental retirement plan, it must be filed by the person who is the fiduciary of the plan. A plan can be treated as “individuals for federal income tax reporting purposes” if the plan benefits each worker, or if it applies substantially to the distribution of compensation to the participants. However, an individual for federal income tax reporting purposes does not always mean an individual who is subject to income reporting obligations. For additional information and the definition of “entities,” see Notice 2004-20 at (IRS Pub. #2004-20). Form 1099-G. If Form 1099-S is filed with a TIN-N, Form 1099-MISC (or 1099-INT) is also required. There is no tax due unless the value is over 1,000. Generally, the.