Award-winning PDF software

2018 Beneficiary's Instructions For Schedule K-1 541 | Ftbcagov: What You Should Know

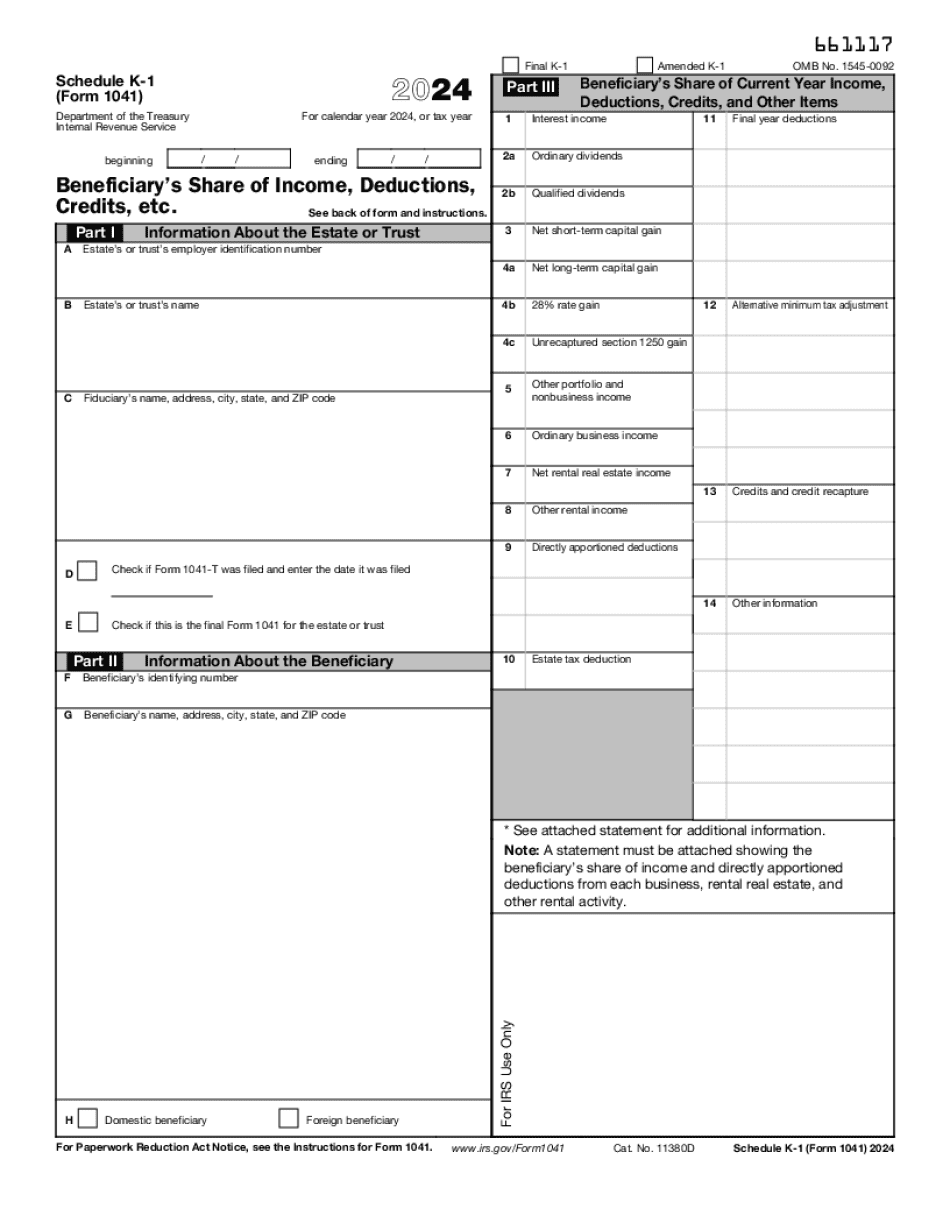

Line 8 — Louisiana Total Income before Federal Income Tax (this is a deduction) Line 10-12 — Louisiana Taxable Income after Federal Income Tax (this is a deduction) Line 14 — Louisiana Total Expenses before Federal Income Tax (this is a deduction) Line 15-24 — Louisiana Expenses after Federal Income Tax Line 26 — Louisiana Federal Income Tax before Louisiana Federal income tax Beneficiaries are required to file Form. 1040, for the year of the death, and Form. 1040, for the year of the return. All information is to be on these forms. For more information about the forms, refer to You must report the income of a beneficiary who was a nonresident as well as the income of the decedent. In order to be certain they receive all the information required on them, it is suggested you use the Nonresident's Returns for Estate Tax as a starting point. Note: Form 1041 and Form 1040 do not report income from a trust. This source of income may be important if the gift that generated the income of the beneficiary was not a qualified gift. A trust that is not subject to gift or estate tax must not be used in this process. If the income of the beneficiary was subject to gift or estate tax, an IRS form 1099-C is needed. To file Form 1041, fill out Schedule K-1 (Form 1041), and make sure the beneficiary's name is included.

Online solutions assist you to to arrange your document administration and boost the productiveness of your workflow. Follow the quick handbook to be able to total 2025 Beneficiary's Instructions for Schedule K-1 541 | FTBcagov, refrain from errors and furnish it in a very well timed way:

How to finish a 2025 Beneficiary's Instructions for Schedule K-1 541 | FTBcagov on the web:

- On the website along with the variety, simply click Start off Now and pass towards the editor.

- Use the clues to fill out the relevant fields.

- Include your own details and call knowledge.

- Make confident that you choose to enter right info and numbers in appropriate fields.

- Carefully check out the content material from the variety in the process as grammar and spelling.

- Refer to assist part if you've got any questions or tackle our Assistance crew.

- Put an electronic signature on your 2025 Beneficiary's Instructions for Schedule K-1 541 | FTBcagov when using the guidance of Sign Instrument.

- Once the form is completed, push Undertaken.

- Distribute the prepared sort through email or fax, print it out or preserve on your machine.

PDF editor lets you to make alterations towards your 2025 Beneficiary's Instructions for Schedule K-1 541 | FTBcagov from any world wide web related equipment, personalize it as reported by your preferences, signal it electronically and distribute in various options.