Award-winning PDF software

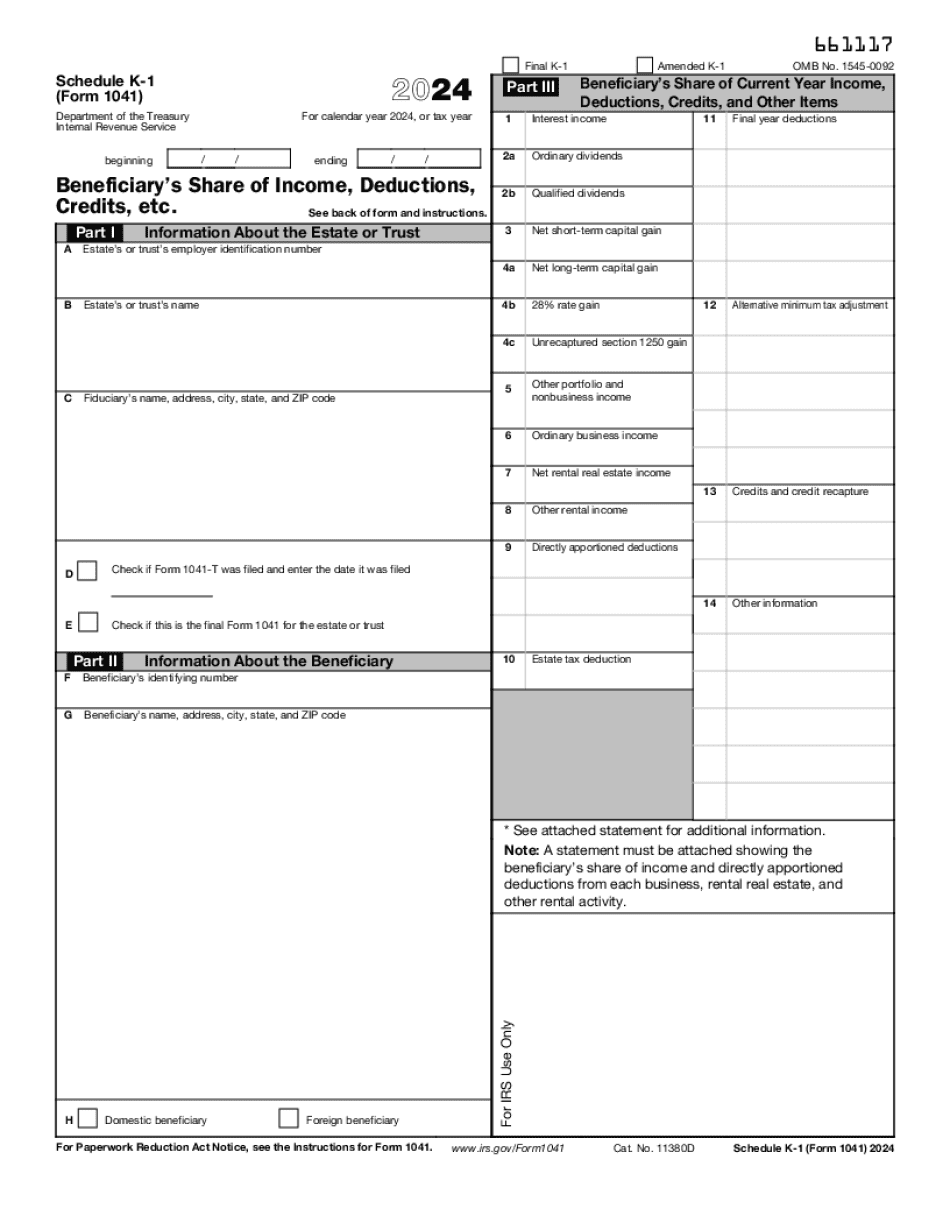

Schedule K-1 (Form 1041) - Deductions, Credits & Other Items: What You Should Know

What is an Estate Tax Exemption? No income tax is due on estates or trusts that have less than 12,700 of gross assets (adjusted gross income — AGI). For an individual, estates or trusts valued at 11,150 or less of AGI are exempt from annual income tax. For taxable estates of individuals, estates and trusts valued at 10,100 or less are exempt from annual income tax if any beneficiary is under age 62. For taxable estates of trusts, estates and trusts valued at 10,750 or less or the exemption applies, a taxable estate is taxable income and is subject to the estate tax. What is a Deceased Beneficiary? A beneficiary of a decedent is a person (trustee, estate or partner) who, if the decedent died, would be entitled to all or a portion of the estate or trust (unless the decedent expressly gave the beneficiaries or heirs the right to an equal share of the estate or trust). A deceased beneficiary is considered the decedent's estate or trust. What are the Forms 1040, 1040A, and 1040EZ? 1040, 1040A, and 1040EZ: These forms are used to determine what income tax you owe for the year you file your personal tax return. Forms 1040 and 1040A: These Form 1040s are used to report income and certain capital gains and losses. Federal Income Tax Deduction Schedule Line 1 Schedule A Line 13 Schedule A Line 14 Schedule A What Do the IRS Call It: Taxable Estate, Trust, or Revocable Trust Filing Form 1120, Estate, Trust, or Revocable Trust — The IRS calls them taxable estates, trusts, and revocable trusts. Filing Your Forms 1040, 1040A, and 1040EZ: These forms are used to determine what income tax you owe for the year you file your personal tax return for the year. How Do Your Forms Apply to Your Estate? Your Personal Tax Return: All your personal returns, including tax refunds, must be filed by April 15th each calendar year. When The Time Comes To Pay Your Estate Taxes If you have more than 20.5 million of gross estate or trust assets (adjusted gross estate or AGI), you have to report what you have left or are left.

Online alternatives assist you to arrange your document management and supercharge the productiveness of your workflow. Stick to the quick information as a way to finish Schedule K-1 (Form 1041) - Deductions, Credits & Other Items, steer clear of faults and furnish it inside of a timely fashion:

How to complete a Schedule K-1 (Form 1041) - Deductions, Credits & Other Items on line:

- On the website along with the sort, click Start off Now and pass with the editor.

- Use the clues to complete the suitable fields.

- Include your own information and make contact with facts.

- Make guaranteed that you choose to enter accurate knowledge and figures in proper fields.

- Carefully check the written content belonging to the kind too as grammar and spelling.

- Refer to help section if you have any issues or deal with our Service group.

- Put an digital signature on your Schedule K-1 (Form 1041) - Deductions, Credits & Other Items with the aid of Sign Tool.

- Once the shape is done, press Executed.

- Distribute the prepared type by means of e mail or fax, print it out or save on your equipment.

PDF editor will allow you to make changes on your Schedule K-1 (Form 1041) - Deductions, Credits & Other Items from any on-line linked unit, customise it in line with your needs, indication it electronically and distribute in various means.