PDF IRS Form 1041 (Schedule K-1) 2024-2025

Show details

Hide details

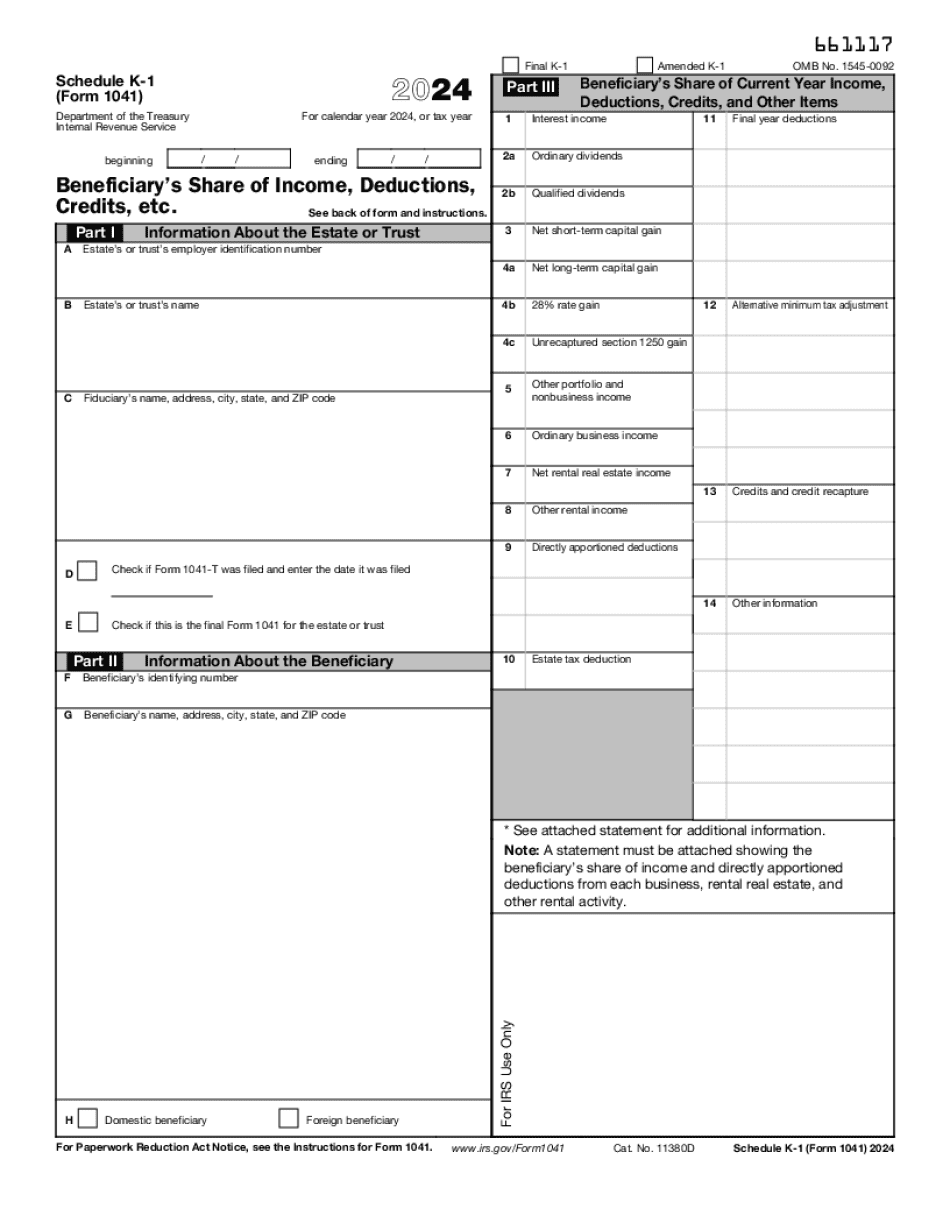

0092 Deductions Credits and Other Items Interest income 2a Ordinary dividends 2b Qualified dividends Net short-term capital gain 4a Net long-term capital gain 4b 28 rate gain 4c Unrecaptured section 1250 gain Other portfolio and nonbusiness income Ordinary business income Net rental real estate income Other rental income Directly apportioned deductions Final year deductions Alternative minimum tax adjustment Credits and credit recapture Other information Estate s or trust s employer ...

4.5 satisfied · 46 votes

form-1041-schedule-k-1.com is not affiliated with IRS

Filling out Form 1041 (Schedule K-1) online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A full guideline on how to Form 1041 (Schedule K-1)

Every citizen must report on their finances in a timely manner during tax period, providing information the IRS requires as precisely as possible. If you need to Form 1041 (Schedule K-1), our secure and intuitive service is here to help.

Follow the instructions below to Form 1041 (Schedule K-1) quickly and efficiently:

- 01Upload our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Read the IRSs official instructions (if available) for your form fill-out and accurately provide all information required in their appropriate fields.

- 03Complete your document utilizing the Text option and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the tool pane above.

- 05Use the Highlight option to stress particular details and Erase if something is not relevant any longer.

- 06Click the page arrangements key on the left to rotate or remove unnecessary file sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to ensure youve provided all details correctly.

- 08Click on the Sign tool and create your legally-binding eSignature by adding its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your report from our editor or choose Mail by USPS to request postal document delivery.

Opt for the best way to Form 1041 (Schedule K-1) and report on your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is irs printable tax form schedule k1 form1041?

Online technologies make it easier to organize your document administration and increase the efficiency of the workflow. Follow the quick manual in order to fill out IRS printable tax form schedule k1 form1041, stay away from errors and furnish it in a timely manner:

How to complete a k1 form?

- 01On the website with the blank, choose Start Now and go to the editor.

- 02Use the clues to fill out the suitable fields.

- 03Include your individual data and contact information.

- 04Make sure that you enter accurate details and numbers in suitable fields.

- 05Carefully revise the information of your form as well as grammar and spelling.

- 06Refer to Help section if you have any questions or contact our Support staff.

- 07Put an digital signature on the IRS printable tax form schedule k1 form1041 printable using the help of Sign Tool.

- 08Once the form is finished, press Done.

- 09Distribute the ready document by using email or fax, print it out or save on your gadget.

PDF editor permits you to make alterations in your IRS printable tax form schedule k1 form1041 Fill Online from any internet linked gadget, customize it in line with your requirements, sign it electronically and distribute in different means.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 1041 (Schedule K-1)?

Schedule K-1 is used to calculate the individual's tax liability for the taxation year. The number of shares included in the return of income is used to calculate the gross income. The gross income is further divided into income from capital and income for which a deduction is allowed.

If the taxpayer is an individual, the Schedule K-1 also includes contributions that are for capital losses/gains. In general, these are deducted from the gross income. For this type of deduction, you also include the shareholder's Shareholder's Distributions (Form 1099) to calculate net income for the year on the return of income.

If the taxpayer is a corporation, the Schedule K-1 also includes losses (losses from dispositions of capital property, etc.) and business income (business income from an income producing activity, etc.). These losses are subtracted from the adjusted basis of capital. The taxpayer then adds the amount of gain recognized by the business or the corporation on the disposition (this amount and any income from the dispositions is generally reported in Box 15 of the Schedule K-1), and the total is adjusted by deducting from it the shareholder's Shareholder's Distributions (Form 1099).

If the taxpayer is a corporation, the Schedule K-1 also includes profits (profit from the disposition of property, etc.) and losses (losses from dispositions where the property is disposed of for more than 2,500,000, or any amount received by the taxpayer as a profit distribution from the corporation). These profits and losses are added along with the adjusted basis of capital.

What is the purpose of Schedule D?

Schedule D is used to determine the net income. It is usually used to deduct interest and dividend income (other than interest on investment income). Generally, Schedule D reduces the amount reported in the “Form 1040” each year by the amount that includes business income, personal income, or net investment income (depending on the year's basis changes and if the taxpayer was required to file a return for the year). Schedule D is usually not used to deduct interest, dividend income, or certain types of compensation.

The Schedule D calculation is as follows:

Net income. The income on which the Schedule D deduction is based equals: Gross income — Adjusted basis of capital.

Expenses: The amount of business property taxes, franchise taxes, and other business expenses.

Who should complete Form 1041 (Schedule K-1)?

You may use this form if you are an individual who is covered by an employment-based retirement plan or individual retirement account (IRA) such as a 401(k), 403(b), or profit-sharing plan.

If you filed a tax return for 2015, and you are an individual, you must complete Form 1040NR (Individual Income Tax Return) to report your income. The form also requires that you choose the applicable deduction or itemized deductions. The tax return is available for download by clicking here.

If you are a self-employed person, follow IRS Publication 517 (Self-Employment Tax Guide) as a substitute for the IRS Form 1040NR.

You must include information about the following items on your Schedule K-1, if the information you report appears on Schedule C, line 1 on Form 1040, Schedule C, line 20, Schedule S, lines 2 and 3, or Form 1040NR.

When do I need to complete Form 1041 (Schedule K-1)?

If you can do so without incurring penalties, generally you should do so by early December. Since late December may be too cold for many small businesses with fewer than 20 employees, if they do not have enough money to complete Form 1041 by the due date you should notify the IRS via postal mail of the date of the submission on Form 1041, and request any extensions you need. For more information, see the instructions on Publication 557. If there is any confusion about whether Form 1041 will become effective after the due date, you should contact your agent for filing instructions.

What happens when the 1040EZ (or other small business) returns don't include enough income or deductions to meet their obligations?

If the 1040EZ reports under the regular method of accounting, the IRS will require you to provide information on the form including an explanation why each return is not enough to discharge your tax liability. For information on special reporting requirements of Form 1040EZs, see the Instructions for Form 1040, or refer to our “Additional Information for Individuals” section about Form 1040EZ. The IRS will not count an adjustment to the value of the business or assets against deductions required under the regular method that may not be reflected on the 1040EZ for the period of the adjustment. For information, see the Instructions for Form 1040, or refer to our “Additional Information for Individuals” section about Form 1040EZ.

My tax preparer told me I should enter the wrong income from the last tax year in my 2. What should I do?

There are cases when a tax preparer or professional should enter the wrong income into the computer and should re-enter the correct income upon the completion of Form 1040. To do this, the preparer should ensure the correct value is entered on your last tax year return. There are many reasons that a taxpayer may not be able to deduct all or part of his or her income for a tax year. Here are the most likely reasons:

(1) The taxpayer left some money on the table in 2012. The taxpayer has left enough income on the table for you to re-enter the correct income on Form 1040, even though your software did not provide the correct amount. If the taxpayer didn't include any income, this is because the taxpayer doesn't have income and is unable to claim it.

Can I create my own Form 1041 (Schedule K-1)?

Yes. If you've registered to claim this exemption as a dependent (as a student or as a job seeker), you can write your own Schedule K-1 (it must also contain a separate item showing all the information required on Schedule K). Write Form 1041 (Schedule K-1) if the taxpayer is age 17 or under as of January 1, 2026. Include the information below on your Schedule K:

the taxpayer's address and Social Security number;

the taxpayer's name and date of birth;

the taxpayer's employer information (if any); and

the taxpayer's marital status;

the address of the taxpayer's source of income;

the address of the job or business the taxpayer is employed at;

the number of hours the taxpayer claims as a deduction from wages (if any), or claims as a credit against wages, to be able to show wages earned;

the number of days or weeks the taxpayer claims as a deduction from wages (if any), or claims as a credit against wages, to be able to show wages earned; and

If the taxpayer was employed in a bona fide trade or business or was regularly engaged in an occupation described in section 457(b), the number of hours worked per week. These are the requirements of the Form 1041 (Schedule K-1). See Publication 1040, Employer's Tax Guide.

If the taxpayer is over 75, you must include on one or more pages the additional information prescribed in paragraph (b)(4) of this section. The taxpayer may claim the child tax credit as provided in section 6001 of the Internal Revenue Code.

The form must show information on the tax year of the Form 1041, and the filing status for the taxpayer. If you are filing multiple Forms 1041 in any year, include additional information for each Form 1041. The requirements for this form are the same as those for the original Form 1041.

What does the Form 1041(S)(3) cover?

Your Form 1041 (Schedule K-1) will be used to provide information to the IRS to establish the student's dependents, including the students. A student must include the Form 1041 (Form K-1) on the Form 1041 S-3, Statement of Tax Beneficiaries and Allowances (Form 1041-SA).

What should I do with Form 1041 (Schedule K-1) when it’s complete?

When you receive Form K-1, you will receive an instructions page. In most cases, you should just follow your instructions, as the IRS does not have to verify or approve your Form 1041.

However, the IRS does have a specific policy that states how you should properly file Form 1041 (Schedule K-1). Your Form 1041 (Schedule K-1) should be filed on a “timely basis” for the three years the filing was made.

For more information, see the instructions in the 2017 Form 1041 instructions or the Instructions Guide for 2017 and 2018 Form 1041

Other questions? Ask here or contact the Taxpayer Advocate Service.

If you are claiming a dependency exemption, you must file Form 8862.

How do I get my Form 1041 (Schedule K-1)?

Form 1041 (Schedule K-1) is an annual tax form. You should file to get your Form 1041 and payment instructions from the IRS no later than April 15 of the following year. You should submit Form 1041 to the IRS no later than April 15 of the current year, with all of your information and attachments.

For more information about tax forms filed by individuals, see the Instructions for Form 1040, 1040-EZ, 1040A, or 1040NR. For information about tax forms filed by religious organizations, see the Instructions for Form 1023 or 1023-I.

What documents do I need to attach to my Form 1041 (Schedule K-1)?

Yes. For most taxpayers, the Form 1041 or the Statement of Basis for Exempt Organization (SHOE) is used to report information on the organization's status, as well as the nature of its services, expenses, and assets.

What documents are needed for a foreign corporation?

A certificate of non-U.S. ownership is necessary for a foreign corporation.

Other information that you must include in a Form 1041 or SHOE:

Form 8886, U.S. Certificate of Foreign Status

A list of current U.S. assets and liabilities, and a breakdown of them by type (including any deferred foreign income).

For each item and each person, include their full name, address, and tax year. You must also list any income or loss from activities not classified as income or loss.

To determine your reporting period, you must complete a Form 4038, Report of Foreign Corporation Income or Loss for the Annual Return Period.

For additional guidance on filing Form 8886, see Publication 4681, Foreign Corporation Income and Expenses.

What information do you need to report in a Form 1042?

The following information reports to the IRS when an American expatriate or severs ties with the United States:

An American's Form 1044, U.S. Treasury Order of Leave, must be filed with the IRS (unless the American is a beneficiary of a trust and the IRS is the trustee of the trust).

If an expatriate is a U.S. citizen with income, wages, or other remuneration from foreign sources, a Form 1040NR, U.S. Individual Income Tax Return for the Year of U.S. Citizenship or Naturalization, must be filed with the IRS. This information must also accompany all the other instructions for the Form 1040NR.

If an expatriate is a foreign corporation with income, wages, or other remuneration from foreign sources, a Form 1041 and a Form 4038 should be filed with the IRS. These materials should also accompany all the other instructions for the Form 1041 and Form 4038.

For further information on how to file an American's Form U.S.A. Return if they have taxable income from foreign sources, please refer to Publication 519, U.S. Individual Tax Guide — Taxable Income.

What are the different types of Form 1041 (Schedule K-1)?

There are two types of Schedule K-1 tax returns, one where the income is reported by type or value, and another where it's reported by income source.

Generally speaking, Schedule K-1s are usually used to report payments or grants received under the following programs, which are:

Social Security Disability Insurance

Medicare

Coverage under a worker's compensation plan like Workers' Comp

Supplemental Security Income (SSI)

Temporary Assistance for Needy Families (TANK)

Housing Assistance Payments (HAP)

WIC

Social Security Survivor's Benefits (RSSB)

The Supplemental Nutrition Assistance Program (SNAP)

Medicaid

The Earned Income Tax Credit (ETC), which is the refundable portion of the income tax, can also be reported. You pay a tax credit on the amount which exceeds your annual income tax liability.

Form 1041 (Schedule K-1) includes two other categories of income.

Self-employment income. You can earn income in two ways, either self-employed or independent contractor. Self-employment income is a taxable portion of your income. Independent contractors are those who receive a salary at their own business. You cannot be self-employed and receive SNAP or SSI unless your state qualifies if you qualify for assistance.

Non-social security income. This is made up of unearned income. This includes wages, salary, tips, commissions, annuity, pension, social security and pensions. Social Security is a retirement benefit not a check. You are not eligible for social security if you did not receive benefits during the year.

Most income which are exempt from US federal tax under the self-employment tax rules should likely be included, because they are treated as income, and taxable, by the state when calculating the income tax that you must pay. However, if your state income tax requires you to pay taxes with an exception for all unearned income (such as rental income), this is a good opportunity to include your rent or your utilities.

Form 1041 is filed in paper form, and you will need to have it returned to the IRS (via the mail). You should keep a current copy for your records.

Note that your Schedule K-1 may need to be filed electronically through Service Bureau when you first file.

How many people fill out Form 1041 (Schedule K-1) each year?

There are approximately 7.9 million workers who fill out Form 1041 each year.

Which type of business do most people report as a trade or business on Schedule K-1?

In 2014, the largest trade or business was an employer of farmworkers (which include farm or fishing workers, and nonfarm self-employed home health workers and home health aides). The largest business category was government: a general (not specified) or governmental organization.

Is one individual considered to be an independent contractor if they have more than one business?

No. You need to have at least one business in order for your employer to be an employer of an individual. Each of your businesses can be part of your employee's income, but you don't need to have a full-fledged partnership to be an employer.

Do all trades and businesses need to fill out Schedule K-1?

No. Generally, the types of business you can form as an employer include sole proprietorship, partnerships, and S corporations. Most trade or business forms are designed to report your wages to a payee.

If you are the sole shareholder, and you have one or more of your companies as your trade or business, the IRS requires that you report your wages and your share of the partnership income in a Schedule K-1. If you are an S corporation and your company is a partnership, you will also need to fill out Schedule K-1.

Who will file Form 1041?

You or your representative will file Form 1041 if:

you or your beneficiary are the owner of at least 50 percent of the partnership;

you or your beneficiary operate any part of the corporation, partnership, or S corporation solely for your own personal, family, or household use; and

You, or your beneficiary, own any interest in the business.

Form 1041 is filed with most federal income tax returns. You may also choose to file Form 1041 electronically, even if you don't own a partnership. However, if you do own a partnership, and you don't choose to file with Form 1041, you only need to include partnership income on Schedule K-1 (see the instructions for Schedule K-1 for more information).

I am an employee, as opposed to an owner of a partnership. My partner uses me for home health services. Can I report myself on Schedule K-1 as the employee?

Yes.

Is there a due date for Form 1041 (Schedule K-1)?

Yes, the due date for Form 1041 (Schedule K-1) is the date of the issuance of the report on the company. However, if the company is under audit or tax enforcement or audit is not scheduled, Form 1041 (Schedule K-1) is issued on the last day of the taxable year.

Do I need to file Form 1041?

You must file the form if:

You are required to file a tax return

You are a recipient of a tax-free distribution

You are treated as not having paid a tax

You are a qualified retiree or are a non-resident alien

Filing taxes is not a requirement, but you may need to pay federal income taxes.

How is Schedule K-1 Formed?

A company that is subject to tax withholding will use Form 1040, U.S. Individual Income Tax Return, to report its income taxes and payments. However, some businesses that are not required to withhold taxes and payments may file their income tax returns on their own. This is called an “incorporated” business. If the IRS requires Form 1041 (Schedule K-1) then the corporate tax return will also be filed with the Form 1040.

If the IRS grants you tax-free status, you may receive Form 1041, U.S. Return for Tax Free Distribution of Distributions from a Trust (see section on Form 1041). The Form 1041 will not contain a Form 1041 (Schedule K-1).

What Form are I required to file?

You must follow the instructions in Form 1041, U.S. Return for Tax Free Distribution of Distributions from a Trust (see sections 2, 3, 4, and 5 below). Note that Forms 1041 (Schedule K-1) are not filed with Form 1040.

How do I file a tax-free distribution from a trust?

If the income you earned is not taxable to you, you may be eligible to receive a return of distribution (a Form 1041-T). A trust may receive income from property held in it, but not income from property held by individuals or businesses. A trust may receive income from any source or from none.

Form 1041-T is used to make distributions from a trust's interest in property held by the trust.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here